[Editor’s note: The Higher Education Inquirer has attempted to contact the House Select Committee on the Chinese Communist Party a number of times regarding our extensive investigation of Ambow Education and HybriU. As of this posting, we have never received a response.]

In the evolving landscape of U.S. higher education, one emerging force has attracted growing concern from the Higher Education Inquirer but remarkably little attention from policymakers: Ambow Education’s HybriU platform. Marketed as a next-generation AI-powered “phygital” learning solution designed to merge online and in-person instruction, HybriU raises serious questions about academic credibility, data governance, and foreign influence. Yet it has remained largely outside the scope of inquiry by the House Select Committee on the Chinese Communist Party.

Ambow Education has long operated in opaque corners of the for-profit higher education world. Headquartered in the Cayman Islands with a U.S. presence in Cupertino, California, the company’s governance and leadership history are tangled and controversial.

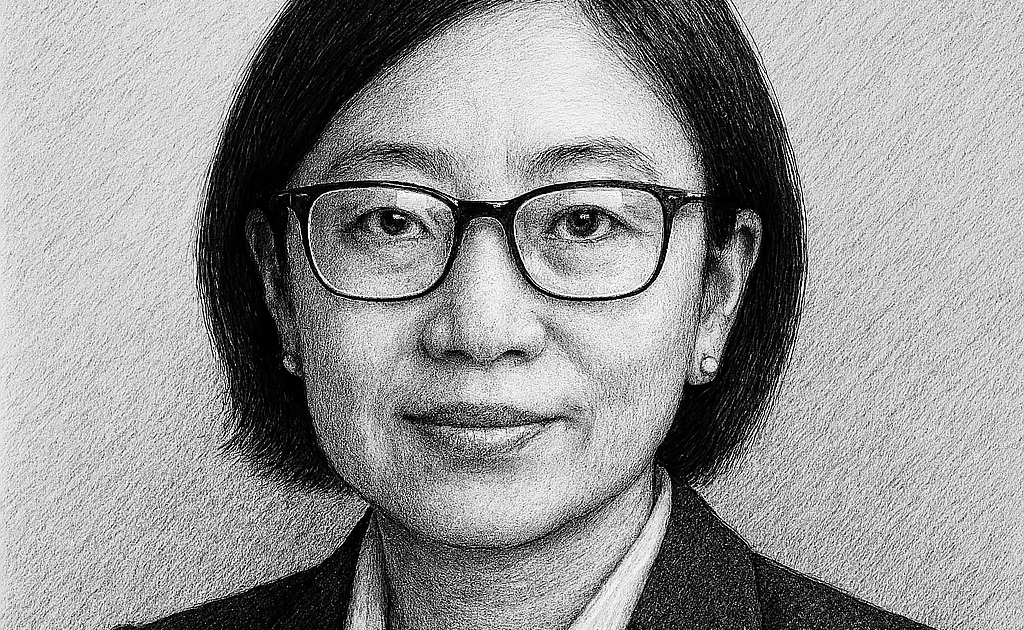

Under CEO and Board Chair Jin Huang, Ambow has repeatedly survived regulatory and institutional crises, prompting the HEI to liken her to “Harry Houdini” for her ability to evade sustained accountability even as schools under Ambow’s control deteriorated. Huang has at times held multiple executive and board roles simultaneously, a concentration of authority that has raised persistent governance concerns. Questions surrounding her academic credentials have also lingered, with no publicly verifiable evidence confirming completion of the doctoral degree she claims.

Ambow’s U.S. footprint includes Bay State College in Boston, which was fined by the Massachusetts Attorney General for deceptive marketing and closed in 2023 after losing accreditation, and the NewSchool of Architecture and Design in San Diego, which continues to operate under financial strain, low enrollment, leadership instability, and federal Heightened Cash Monitoring. These institutional failures form the backdrop against which HybriU is now being promoted as Ambow’s technological reinvention.

Introduced in 2024, HybriU is marketed as an AI-integrated hybrid learning ecosystem combining immersive digital environments, classroom analytics, and global connectivity into a unified platform. Ambow claims the HybriU Global Learning Network will allow U.S. institutions to expand enrollment by connecting international students to hybrid classrooms without traditional visa pathways. Yet independent reporting has found little publicly verifiable evidence of meaningful adoption at major U.S. universities, demonstrated learning outcomes, or independent assessments of HybriU’s educational value, cybersecurity posture, or data governance practices. Much of the platform’s public presentation relies on aspirational language, promotional imagery, and forward-looking statements rather than demonstrable results.

Compounding these concerns is Ambow’s extreme financial fragility. The company’s market capitalization currently stands at approximately US$9.54 million, placing it below the US$10 million threshold widely regarded by investors as a major risk category. Companies at this scale are often lightly scrutinized, thinly traded, and highly vulnerable to operational disruption. Ambow’s share price has also been highly volatile, with an average weekly price change of roughly 22 percent over the past three months, signaling instability and speculative trading rather than confidence in long-term fundamentals. For a company pitching itself as a provider of mission-critical educational infrastructure, such volatility raises serious questions about continuity, vendor risk, and institutional exposure should the company falter or fail.

Ambow’s own financial disclosures report modest HybriU revenues and cite partnerships with institutions such as Colorado State University and the University of the West. However, the terms, scope, and safeguards associated with these relationships have not been publicly disclosed or independently validated. At the same time, Ambow’s reported research and development spending remains minimal relative to its technological claims, reinforcing concerns that HybriU may be more marketing construct than mature platform.

The risks posed by HybriU extend beyond performance and balance sheets. Ambow’s corporate structure, leadership history, and prior disclosures acknowledging Chinese influence in earlier filings raise unresolved governance and jurisdictional questions. While the company asserts it divested its China-based education operations in 2022, executive ties, auditing arrangements, and opaque ownership structures remain. When a platform seeks deep integration into classroom systems, student engagement tools, and institutional data flows, opacity combined with financial fragility becomes a systemic risk rather than a marginal one.

This risk is heightened by the current political environment. With the Trump Administration signaling a softer, more transactional posture toward the CCP—particularly in areas involving business interests, deregulation, and foreign capital—platforms like HybriU may face even less scrutiny going forward. While rhetorical concern about China persists, enforcement priorities appear selective, and ed-tech platforms embedded quietly into academic infrastructure may escape meaningful oversight altogether.

Despite its mandate to investigate CCP influence across U.S. institutions, the House Select Committee on the CCP has not publicly examined Ambow Education or HybriU. There has been no hearing, subpoena, or formal inquiry into the platform’s governance, data practices, financial viability, or long-term risks. This silence reflects a broader blind spot: influence in higher education increasingly arrives not through visible programs or exchanges, but through software platforms and digital infrastructure that operate beneath the political radar.

For colleges and universities considering partnerships with HybriU, the implications are clear. Institutions must treat Ambow not merely as a technology vendor but as a financially fragile, opaque, and lightly scrutinized actor seeking deep integration into core academic systems. Independent audits, transparent governance disclosures, enforceable data-ownership guarantees, and contingency planning for vendor failure are not optional—they are essential.

Education deserves transparency, stability, and accountability, not hype layered atop risk. And oversight bodies charged with protecting U.S. institutions must recognize that the future of influence and vulnerability in higher education may be written not in classrooms, but in code, contracts, and balance sheets.

Sources

Higher Education Inquirer, “Jin Huang, Higher Education’s Harry Houdini” (August 2025)

https://www.highereducationinquirer.org/2025/08/jin-huang-higher-educations-harry.html

Higher Education Inquirer, “Ambow Education Continues to Fish in Murky Waters” (January 2025)

https://www.highereducationinquirer.org/2025/01/ambow-education-continues-to-fish-in.html

Higher Education Inquirer, “Smoke, Mirrors, and the HybriU Hustle: Ambow’s Global Learning Pitch Raises Red Flags” (July 2025)

https://www.highereducationinquirer.org/2025/07/smoke-mirrors-and-hybriu-hustle-ambows.html

Ambow Education, 2024–2025 Annual and Interim Financial Reports

https://www.ambow.com

Market capitalization and volatility data, publicly available market analytics

Massachusetts Attorney General’s Office, Bay State College settlement

U.S. Department of Education, Heightened Cash Monitoring disclosures

House Select Committee on the Chinese Communist Party, mandate and public hearings