Monday, we looked at the country’s overall financial situation (dire), and yesterday we looked at how cuts of a magnitude of 15% might affect key programs like the Canada Education Savings Program and the Canada Student Financial Assistance Program. Today, we’re going to look at how a 15% cut might affect the Government of Canada’s research subsidies, which in the main are run through the Ministry of innovation, Science and Economic Development (ISED).

(I will be speaking about “the tri-councils” as a single funding line; I am aware that the Canadian Institute for Health Research (CIHR) is funded through Health Canada but for this exercise it is easier just to lump them together).

Let’s start by acknowledging that ISED is a sprawling mess of a department with small programs with very little political protection littered all over the place. I wouldn’t bet the farm on the $12 million “Futurpreneur Canada” making it out of this budget round alive. I also doubt the Universal Broadband Fund is going to continue at $900 million per year. Computers for Schools (sounded great in the 90s, less so now) and Computers for Schools Interns would also be on my endangered list. I suspect that the various regional development funds might be in for an outsized hit as well. All of which is to say that it is possible that the research enterprise – that is, the tri-Councils, the National Research Council (NRC), the Canada Foundation for Innovation (CFI) and all those organizations that get part or all their money through the Strategic Science Fund – might not get hit with a 15% cut. It’s quite possible all these other areas might take an outsized hit and allow the actual science stuff to get off with a lighter cut.

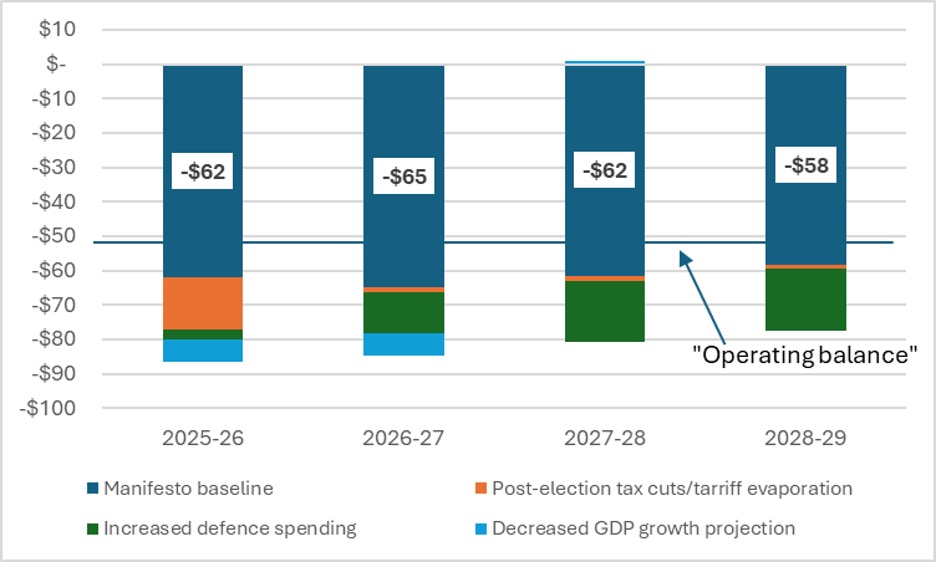

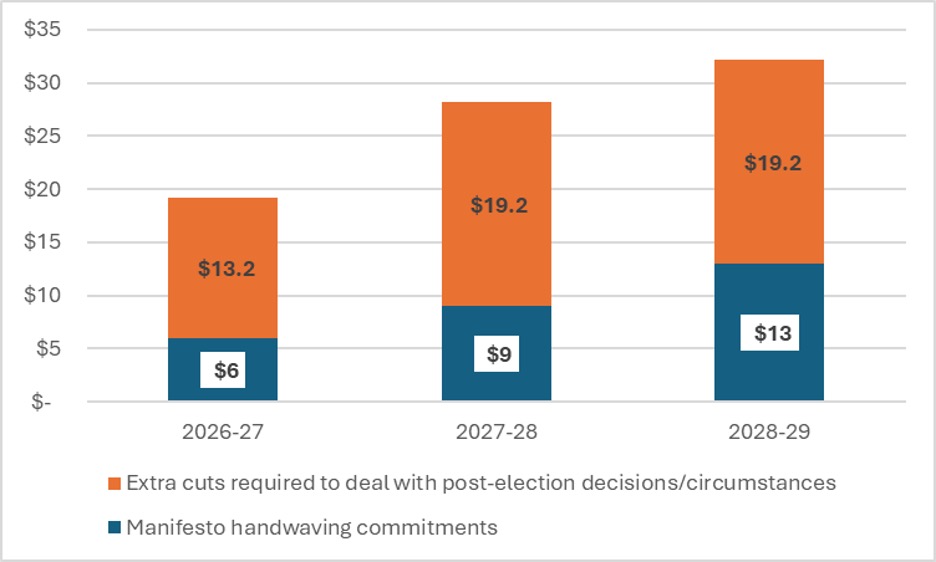

That said, remember this key point: the budget exercise is not about cutting 15% of funding from where it should theoretically be in three years’ time (the government has a fiscal framework that extends out four or five years). It is about cutting expenditures from a 2024-25 baseline. That means that to get through any previously planned increase in spending, the cuts to existing programs must be more than 15%.

This matters for two reasons. First, it is because the government runs its subsidies to electric vehicles manufacturers through ISED. Those subsidies were worth $39M in 2024-25; they were planned to cost $2.1 billion this year and $4.2 billion in 2027-28 (i.e. it’s about half the department’s direct budget spend come two years from now, and about a third of total sci/tech spend if you include the tri-councils). To accommodate that increase while following the letter of the budget reduction request would basically mean requiring the entire department to shut down. That’s probably not happening (though one presumes that Carney’s announcement last week releasing Canadian auto manufacturers from their 20% EV sales target in 2026 might also lead to a reduction in EV subsidies to manufacturers).

Second, remember budget 2024? The one where the Liberals promised $1.8 billion in new spending on research and the whole sector cheered with relief? Yeah, well only $75 million went into the budget framework for 2024-25; 87% of that 1.8 billion is backloaded until after spring 2026. So, basically none of it is protected, and it’s all at risk. I wouldn’t be surprised in the least if they just cancelled the whole thing. And then, on top of that, we must worry about what happens to existing programs, and whether they take a 15% hit.

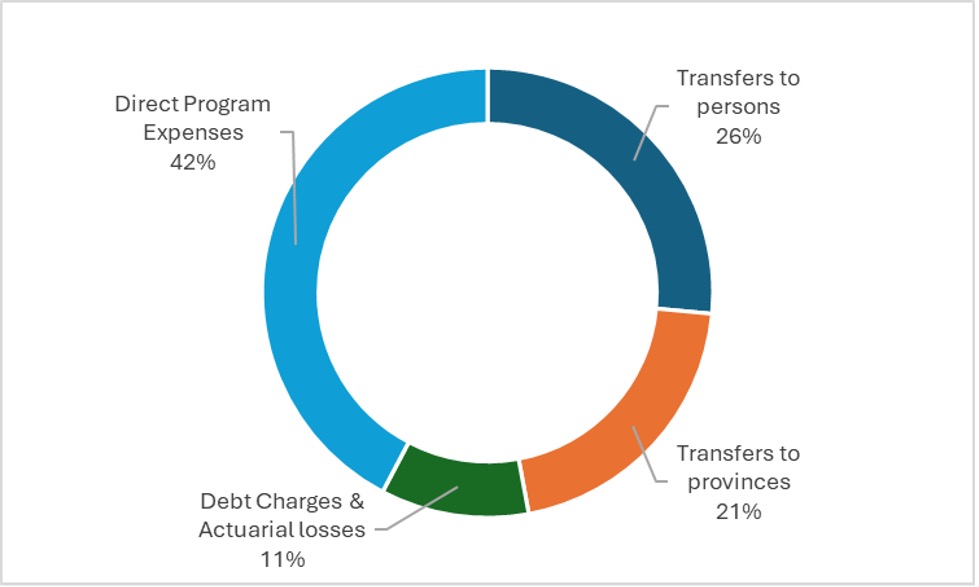

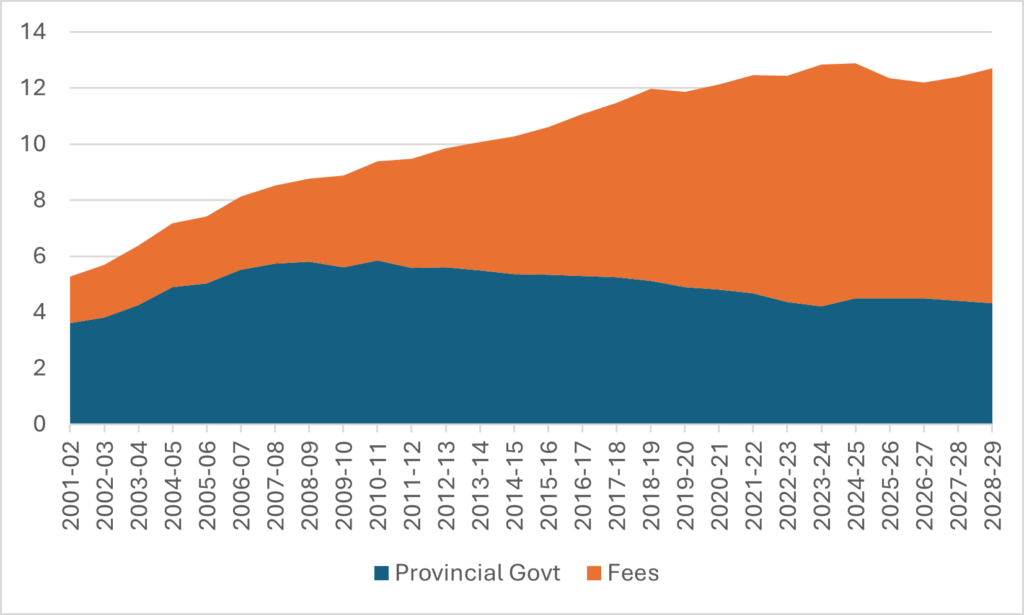

CIHR transfers about $1.2 billion to Canadian post-secondary institutes each year, while the National Science and Engineering Research Council (NSERC) transfers about $1 billion, and the Social Sciences and Humanities Research Council (SSHRC) transfers about $440 million (although a fair bit of that last one includes combined tri-council projects which administratively run through SSHRC, including – if I am not mistaken – funding for the Canada First Research Excellence Fund). CFI is another $550 million a year or so. NRC is about $1.7 billion per year. The Strategic Science Fund is another $900 million or so, closer to a billion if you include base funding for Genome Canada. Canada Research Chairs are another $300 million. Call it $6.2 billion in total. Required savings to get to a 15% cut is therefore just under $1 billion.

Where to start?

Ask most researchers at universities what they would prefer, and the answer is likely that they would eliminate everything except the tri-council funding. Ditch CFI, significantly cut NRC, definitely obliterate the Strategic Science Fund – anything, anything, anything but touch tri-Council grants. I understand the preference, but as I noted last week, this is a monumentally detrimental position for the sector to take. Yes, basic research and the existing grant system are the basis of the existing tenure and promotion system, and as such is naturally dear to those in the system, but almost no one in Ottawa thinks that’s what these systems are for. If we’re going to keep research funding afloat, it’s probably going to be through more spending on things like the Strategic Science Fund.

I have very little insight into the state of official Ottawa’s current thinking on the relative value of these various programs, but I could imagine three basic scenarios that get us to $1 billion in savings.

Option 1 is a straight 15% cut across the board. Take out $400 million or so from the granting councils, $80 million from CFI, $250 million from NRC, cut the Strategic Science Fund and Genome Canada to the tune of $150 million or so, and lose about 350 Canada Research Chairs.

Option 2 would be the spare the professors approach. Now, you probably can’t spare them entirely, because they are such a big proportion of the overall expenditure, but if you jacked up the cuts to CFI, NRC and Strategic Science to say 25%, you could hold the losses to CRCs and the tri-councils to under $100M. I think this is unlikely, but it is a possible scenario.

Option 3 would be the hammer the tri-councils approach. Because, as I said, I don’t think they are particularly well-liked at Finance/PMO. This is close to the inverse of option 2; zero cuts to NRC and Strategic Science, keep the CFI cut at 15% and take the rest of the necessary money out of the tri-councils. That would mean a cut of about $800 million or about 30% to council funding.

And remember, all of this is on top of walking back the measures announced in the 2024 Budget. Ugly doesn’t even begin to cover it.

To be clear: I suspect it is unlikely that the research area will get a cut of 15%, in part because officials will feel bad about doing serious damage to existing budgets after, I suspect, already taking away the Budget 2024 measures. If I had to guess, I would say that the department will probably come down hardest on regional development subsidies. Nevertheless, the scenarios above are possible even if not probable. Universities should start thinking about what they might mean and how they might cope.