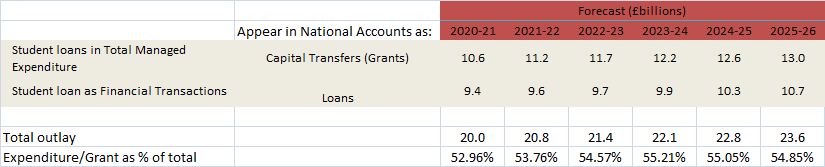

I have constructed the table above from forecasts for Total Managed Expenditure and Financial Transactions taken from the Office for Budgetary Responsibility’s latest publication (it accompanied Wednesday’s Budget).

It shows how newly issued student loans are now split into two components for the purposes of presentation in the National Accounts. The portion of loans that are expected to be repaid are classed as “financial transactions”, while the portion expected to be written off is recorded as capital expenditure. The latter scores in “public sector investment”, which was adopted as a new fiscal target prior to the pandemic (net investment cannot exceed 3% of national income), though the rules are currently under review.

We can see that student loan outlay is expected to reach £20billion in the year to March 2021, rising to £23.6billion in five years’ time.

The majority of new outlay is now expected to be written off and that share rises over the forecast period.

By 2025/26 repayments on all existing loans are projected to re000000000000000ach nearly £5billion per year. (This figure has improved since the sale programme for post-2012 loans was abandoned, since the treasury now gets the receipts that would have gone to private purchasers).

As mentioned in recent posts on here, the Department for Education only currently has an allocation of £4billion to cover the capital transfer / grant element of new loans and so it has to be granted large additional budgetary supplements each year. This situation has dragged on as the planned spending review has been postponed. We can now expect developments in the Autumn.