The “Default Cliff” Has Arrived — Here’s What It Means for You

Millions of borrowers are inching toward what experts call a student loan default cliff. According to new reports from the Congressional Research Service and CNBC, more than 9 million borrowers are behind on payments — with 5.3 million already in default and another 4.3 million just a few missed payments away.

Sen. Elizabeth Warren called it an “economic disaster in the making,” urging the Department of Education to act fast. But for borrowers, the more immediate question is simpler: What happens if my loans default — and can I fix it?

The short answer: yes, you can fix it.

Even if your student loans are in default, there are proven ways to recover, repair your credit, and get back into good standing. Here’s what default really means, why it’s spiking in 2025, and what steps you can take right now to get out.

What It Means to Default on Your Student Loans

Defaulting on your student loans means you’ve gone long enough without making payments that your lender or the federal government officially labels your debt as seriously past due.

For federal student loans, that happens after 270 days (about nine months) of missed payments without deferment, forbearance, or an active repayment plan. Once you hit that mark, your entire balance becomes due immediately — a process called acceleration — and your loan is transferred from your servicer to the Department of Education’s Default Resolution Group or a collection agency.

For private student loans, the timeline is shorter — usually 90 to 180 days of nonpayment, depending on the lender. Private loans don’t qualify for federal relief programs like income-driven repayment or rehabilitation, and lenders can move quickly to collections or even lawsuits.

In short: default turns your loan problem into a legal problem — one that can trigger collections, wage garnishment, and serious credit damage if left unaddressed.

What Happens When You Default on a Student Loan

Defaulting on your student loans can hit hard and fast. Here’s what to expect if it happens:

- Your entire balance becomes due immediately. You lose access to flexible repayment options.

- You lose federal benefits. That includes deferment, forbearance, new aid eligibility, and access to forgiveness programs.

- Collection actions begin. Wage garnishment, tax refund seizure, or withheld Social Security benefits are common.

- Your credit score drops. Many borrowers see a hit of 60 to 170 points, making it harder to qualify for loans, credit cards, or housing.

- Additional fees pile on. Collection costs and interest can quickly inflate your balance.

- The damage lingers. Default stays on your credit report for up to seven years.

That’s the tough part — but the good news is, you can reverse it. Through rehabilitation or consolidation, most borrowers can bring their loans back to good standing and start rebuilding credit within months.

Why Millions of Borrowers Are Facing Default in 2025

After years of pandemic relief, millions of borrowers are falling behind again as student loan payments resume. Reports from the Congressional Research Service show more than 5 million borrowers already in default and another 4 million close behind — what economists now call the “student loan default cliff.”

The End of Post-Pandemic Relief and the “Default Cliff”

When the post-pandemic relief period ended in fall 2024, many borrowers who hadn’t made payments in years suddenly had to restart them. Some managed to catch up, but millions didn’t — either because they couldn’t afford the new bills or never received clear guidance from their servicers.

With delinquency reporting and wage garnishments now back in play, defaults are climbing fast. Economists warn that this wave could squeeze consumer spending and credit access, particularly for families already stretched thin.

Policy Shifts Under the Big Beautiful Bill

The One Big Beautiful Bill Act (OBBB), signed in July 2025, made repayment even tougher for many. The law tightened borrowing limits, replaced familiar repayment plans like SAVE and REPAYE with new ones (RAP and revised IBR), and reduced access to relief programs.

At the same time, staffing cuts at the DoE left over 1 million IDR applications pending — meaning many borrowers are still waiting for payment adjustments that could prevent default.

Why Borrowers Are Falling Behind

Beyond policy, everyday economics are making repayment harder than ever:

- Rising costs: Inflation and high housing prices are squeezing budgets.

- Administrative delays: Servicer confusion and IDR backlogs leave many unsure of their payment status.

- Borrower fatigue: After years of pauses and shifting policies, some borrowers simply checked out.

- Defaults spreading: Even high-credit borrowers are missing payments, often prioritizing essentials over student loans.

The bottom line: the system restarted before it was ready, and millions are paying the price. But while the headlines sound grim, default isn’t permanent — there are still clear, proven ways to fix it and start fresh.

How to Fix a Defaulted Student Loan

Default feels final, but it’s not. The federal system gives borrowers a few clear paths to recover, and most people can get back on track within months — not years.

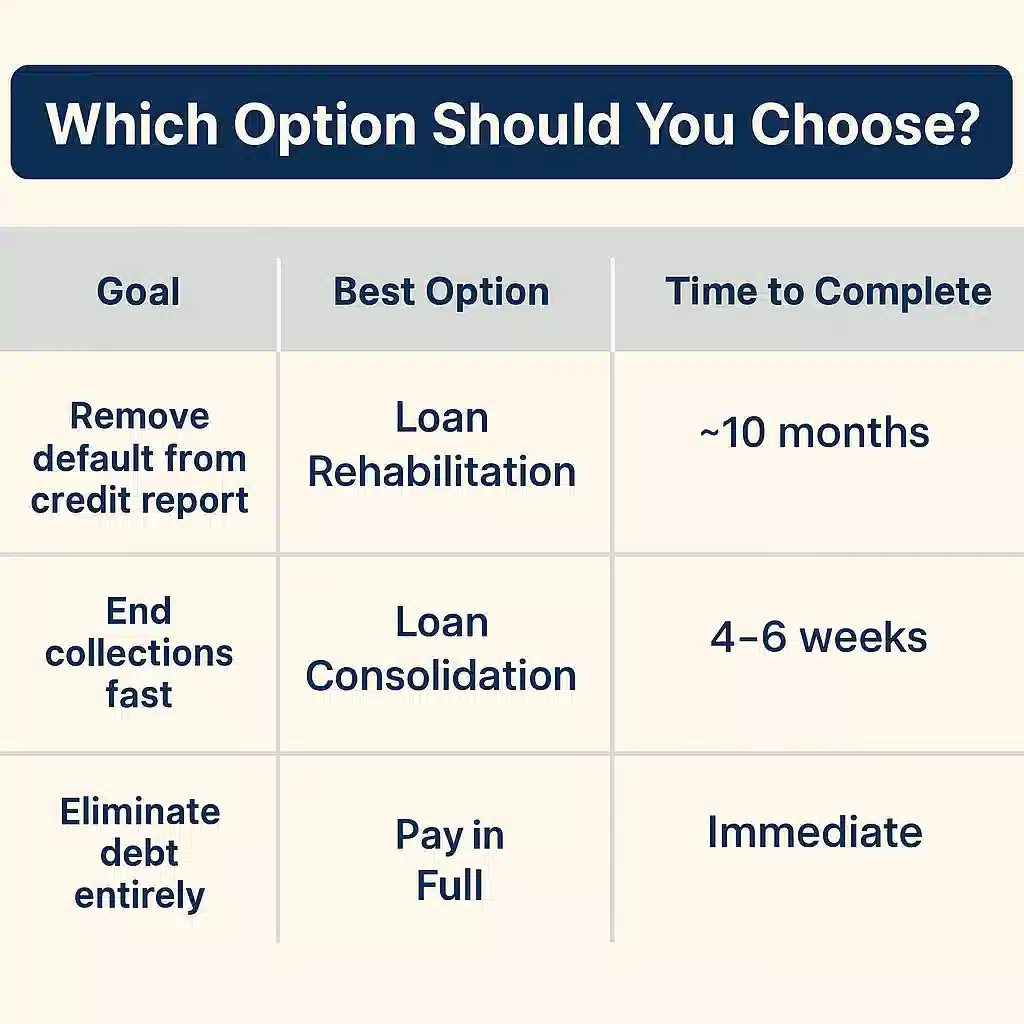

The best way to fix student loan default depends on your situation, but for federal loans, there are three main options: rehabilitation, consolidation, and paying in full. (Private loans work differently — we’ll cover those next.)

Option 1: Loan Rehabilitation (Best for Credit Repair)

Loan rehabilitation is usually the best fix if you want to remove the default mark from your credit report and regain federal loan benefits.

You’ll make nine on-time monthly payments within ten months — typically around 15% of your discretionary income. If that’s too high, your servicer can set a lower amount (sometimes as little as $5) based on your financial situation.

Once you’ve made all nine payments:

- Your loans are taken out of default and reassigned to a new servicer.

- Collection actions like wage garnishment and tax refund seizures stop.

- You regain eligibility for deferment, forbearance, forgiveness, and new aid.

- The default is removed from your credit report (though late payments before default stay).

Best for: Borrowers who want to rebuild credit and have a steady enough income to make small monthly payments.

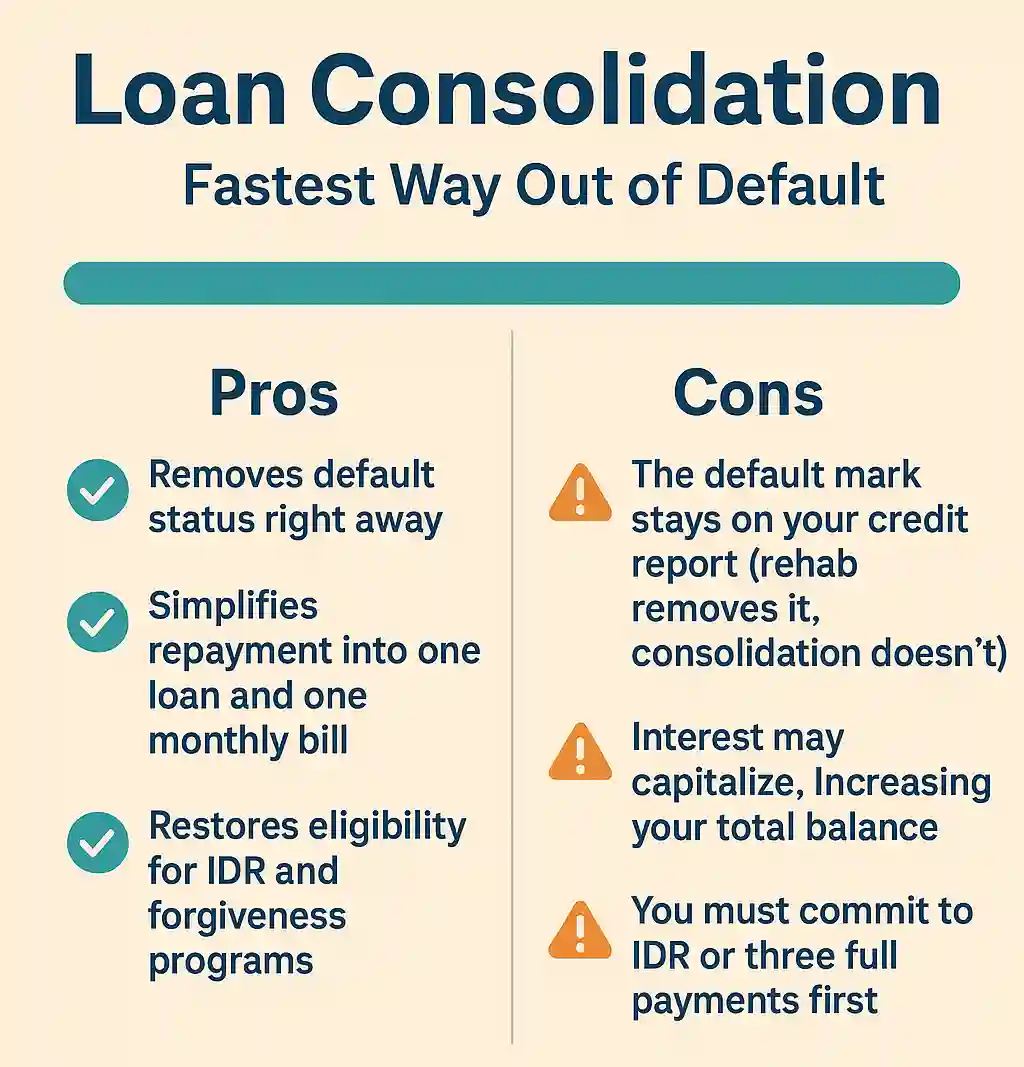

Option 2: Loan Consolidation (Fastest Way Out of Default)

If you need to get your loans out of default quickly, consolidation is faster. You’ll combine one or more defaulted federal loans into a new Direct Consolidation Loan, instantly bringing your account current.

To qualify, you must either:

- Agree to repay the new loan under an income-driven repayment (IDR) plan, or

- Make three consecutive, on-time, full monthly payments before consolidating.

Once approved, your new loan pays off the old ones, ending collections immediately.

Best for: Borrowers who need a fast fix or are facing wage garnishment or collection pressure.

Quick tip: If you plan to apply for a mortgage or new credit soon, consider rehabilitation first — it offers better long-term credit recovery, even if it takes longer.

Further Reading: Not sure whether rehabilitation or consolidation makes more sense for your situation? Check out our detailed comparison: Rehabilitation or Consolidation for Defaulted Student Loans? — it breaks down the pros, cons, fees, and long-term credit impact of each option.

Option 3: Paying the Loan in Full (Rare but Instant Fix)

If you can afford it, paying your defaulted loan in full is the quickest way to clear the debt and end all collection activity. Once paid, your loan is immediately considered current.

However, this isn’t realistic for most borrowers — and it doesn’t remove the default from your credit report. It simply stops the bleeding.

Best for: Borrowers with access to large funds (like an inheritance or settlement) who want to close the chapter on student debt entirely.

Once you’ve fixed the default, the next step is keeping it from happening again. The good news: that’s much easier — and it starts with setting up a repayment plan that actually fits your income.

Related: Fact or Fiction: Can I Pay Off My Student Loans with a Lump Sum? — This article breaks down why lump-sum payoffs rarely work and how to use big payments wisely without wrecking your credit.

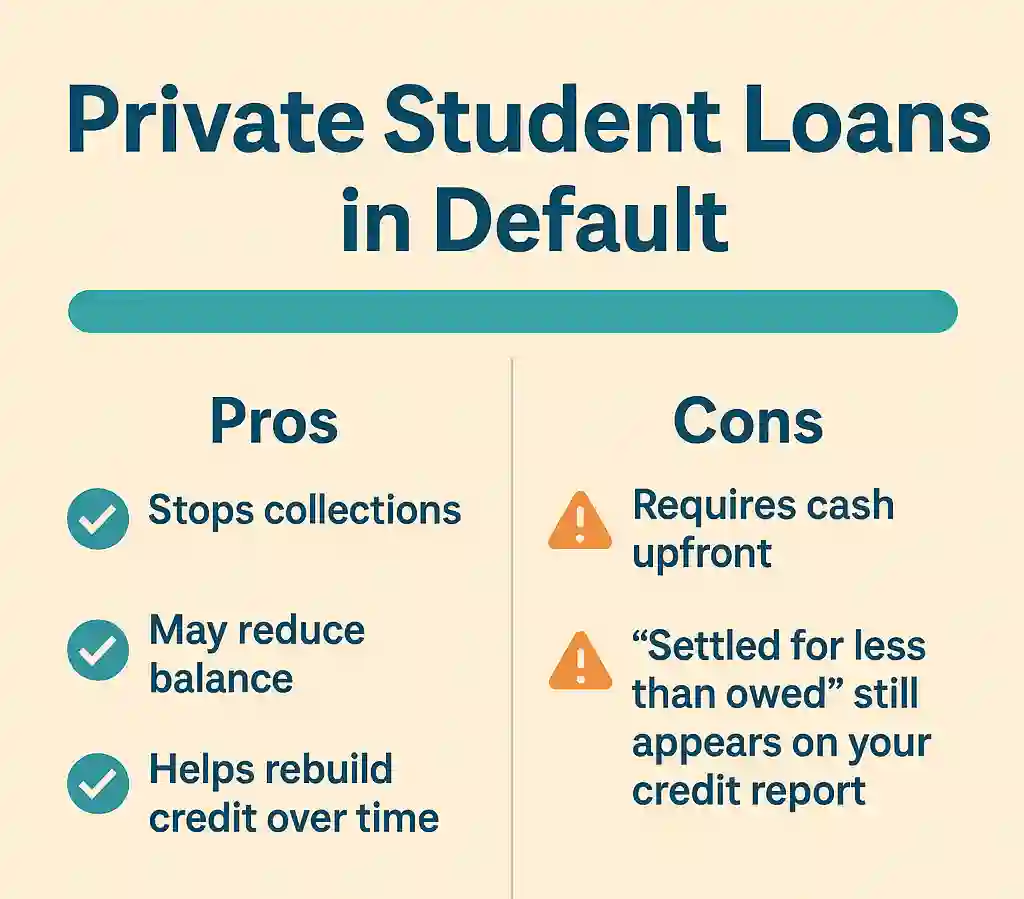

Private Student Loans in Default

Private loans don’t follow federal rules, and they don’t offer rehabilitation. Most private lenders consider a loan in default after 90–180 days of missed payments.

If your private loan defaults:

- Contact your lender immediately — many will negotiate new repayment terms to avoid litigation.

- You can request a settlement, often paying 50–70% of the total balance in a lump sum or short-term plan.

- Be aware that lawsuits are common. Private lenders can sue to garnish wages or seize assets (depending on state law).

Related: Why Most Borrowers Should Repay Private Student Loans First — This article explains why private loans are riskier, how they differ from federal debt, and when it actually makes sense to pay them off first.

Once you’ve fixed the default, the next step is keeping it from happening again. The good news: that’s much easier — and it starts with setting up a repayment plan that actually fits your income.

How to Avoid Student Loan Default Again

Once your loans are back in good standing, the goal is simple: keep them that way. The best way to avoid default again is to make your payments affordable, automatic, and always up to date — even when life gets messy.

Here’s how to stay out of the red for good:

1. Enroll in an Affordable Income-Driven Repayment Plan (IDR)

If your payments feel impossible, that’s a sign you’re probably on the wrong plan.

Switching to an IDR plan keeps monthly payments tied to your income and family size — not your loan balance.

As of 2025, the IBR plan and the new RAP are the most reliable options. The SAVE Plan is still in legal limbo, so new enrollments are limited, but IBR and RAP remain open and safe choices.

Enrolling in an IDR plan can:

- Lower your payment to as little as $0 per month if your income qualifies.

- Keep your account in good standing even if you’re earning very little.

- Keep you eligible for forgiveness programs down the road.

If you’re unsure where to start, visit Studentaid.gov/idr and use the Loan Simulator to compare plans.

Related: Federal Student Loan Repayment Plan Options and Strategy — This article breaks down every repayment plan (SAVE, IBR, PAYE, and more) and explains how to pick the one that minimizes interest and maximizes forgiveness.

Pro tip: If your servicer hasn’t processed your IDR application yet, make at least one small monthly payment anyway — it helps prevent delinquency while you wait through the backlog.

2. Set Up Auto-Pay and Track Your Loan Status

It sounds obvious, but automation is the easiest way to prevent missed payments.

Setting up auto-pay through your loan servicer ensures payments are made on time, every time — and you might even get a small interest rate discount (usually 0.25%).

Don’t just set it and forget it, though. Log in to your StudentAid.gov dashboard at least once a month to:

- Check your payment history

- Verify your servicer hasn’t changed (it happens more than you’d think)

- Review your IDR recertification dates

Even a quick five-minute check can catch errors before they spiral into delinquency.

3. Recertify on Time (Even if the DOE Is Backlogged)

The Department of Education is still digging out from a massive 1.1 million IDR application backlog, which means your paperwork could sit for months. That’s why it’s critical to recertify early — ideally 60 to 90 days before your annual deadline.

If your income or family size changes, recertify right away to keep your payments accurate. Missing your recertification date can cause your payments to jump or your IDR plan to lapse, putting you back on a higher standard plan — the fastest path back to delinquency.

Bottom Line: Consistency Beats Perfection

Avoiding default isn’t about being perfect — it’s about staying consistent.

Pick a repayment plan that fits your life, automate what you can, and keep tabs on your loans at least once a month.

Once you’ve climbed out of default, the hard part’s over. From here, it’s all about maintaining progress — and knowing where to get help before small problems turn into big ones.

Final Take

Defaulting on your student loans can feel like the end of the road — but it’s not. It’s a detour, not a dead end.

Millions of borrowers have been where you are right now and made it out. Whether you choose rehabilitation to clean up your credit or consolidation for a faster fix, the key is to take action before collections get worse. Once you’re out of default, enrolling in an affordable income-driven repayment plan and setting up auto-pay are your best defenses against sliding back.

If your loans are already in default, don’t ignore the problem — you can recover faster than you think.

Check your status on StudentAid.gov, call your servicer, and start the process that fits your situation. Every payment, every step, moves you closer to financial stability and future forgiveness.

Ready to get back on track?

Schedule a one-on-one consultation with Pedro Gomez, CFP®, and get a personalized plan to fix your default, choose the right repayment strategy, and rebuild your financial future — faster.

Book a Student Loan Consultation

FAQs on Student Loan Default

Federal student loans typically go into default after 270 days (about nine months) of missed payments without deferment, forbearance, or an active repayment plan. Private lenders often declare default sooner, usually after 90 to 180 days depending on the loan contract.

For federal loans, you can check your status on Studentaid.gov, which tracks your loan standing. For private loans, you need to monitor your loan servicer’s communications or check your credit report for defaults or collection entries.

The primary ways are loan rehabilitation, consolidation, or settlement. Rehabilitation requires nine on-time monthly payments and removes default status. Consolidation pays off the defaulted loan with a new loan, and settlement involves negotiating payoffs with lenders or collectors.

A federal student loan default typically stays on your credit report for seven years. However, successful rehabilitation removes the default status sooner, improving your credit profile more quickly.

Discharge of defaulted student loans is rare. It is usually granted only in cases of total and permanent disability, school closure, or very limited bankruptcy conditions. Regular discharge through bankruptcy is generally not allowed.

Pedro Gomez is the new Student Loan Sherpa and a Certified Financial Planner™ with over a decade of experience helping clients navigate complex financial decisions. He is the founder of Global Financial Plan, where he writes about international living, geoarbitrage, and strategies for retiring young, and also leads Brickell Financial Group, a registered investment advisory firm focused on accelerating financial freedom.

Pedro is the architect behind the “12 Levels of Financial Freedom” framework and blends student loan strategy with long-term planning, tax efficiency, and investing. His work is especially geared toward upwardly mobile professionals, entrepreneurs, and those looking to design a life beyond the default path.

Pedro is available for strategy sessions and press inquiries.