Moving abroad doesn’t erase your student loans — it just makes managing them more complicated.

Your loans stay with you, and so do the repayment rules.

Where things change is in how your income is reported, verified, and used to calculate payments under an Income-Driven Repayment (IDR) plan. The way you file your U.S. taxes — especially if you claim the Foreign Earned Income Exclusion (FEIE) — can affect what your loan servicer sees as your income and what you owe each month.

Let’s break down what really happens when you take your student loans overseas.

What Moving Abroad Means for Your Federal Student Loans

Living abroad doesn’t cancel your loans, but it changes how you handle them — from repayment calculations to paperwork to keeping contact with your servicer.

Here’s what actually changes when your student loans follow you overseas:

1. Payment Calculation and the FEIE

The biggest shift happens in how your income is treated.

If you claim the FEIE, your Adjusted Gross Income (AGI) looks smaller on your U.S. tax return — and that can lower your IDR payment if your servicer accepts that number as-is.

But that outcome isn’t guaranteed. The Department of Education allows income to be verified using either your AGI from tax data or alternative documentation of all taxable income (Per 34 CFR §685.209(a)(1)(viii)). If that happens, your excluded foreign income could be included in the review.

In practice, though, some borrowers (especially those using the IRS data link on StudentAid.gov) report their lower AGI being accepted, while others are asked to provide pay stubs or other proof of income, which can wipe out the FEIE benefit.

So your payment amount depends on how your income is verified — whether through the IRS data pull (the FTI system) or through Alternative Documentation of Income (ADOI). Even if your excluded income is added back, borrowers with modest earnings or larger households may still qualify for $0 payments under IDR.

2. Communication and Logistics

Keep your contact info current through your servicer’s portal — some accept foreign addresses, others require a U.S. one. If you use a family address, confirm it’s allowed. Go paperless when possible; it’s faster and more reliable overseas.

Most servicers prefer payments from a U.S. bank account, though some do accept online payments from international accounts or via wire transfers. It’s not universal, so always confirm which payment types your servicer supports.

Finally, watch exchange rates and transfer fees — small swings can quietly raise your real payment cost each month.

Related: If you’ll be overseas for a long time, read our guide on managing your student loans while living abroad. It covers practical steps like setting up e-bills, auto-pay, and mail management to avoid missed payments or surprises while you’re away.

3. What Happens If You Don’t Pay

Moving abroad doesn’t make your loans uncollectible.

4. Continued U.S. Tax Obligations

U.S. citizens must file taxes every year, no matter where they live.

Your tax return plays a double role — for compliance and as the base income document for your IDR recertification.

Whether your servicer uses IRS data or ADOI, your tax return is still the foundation for verifying your income.

Common Mistakes for Borrowers Living Abroad

Here are the biggest mistakes expats make — and how to avoid them.

1. Forgetting to recertify income.

Even while abroad, you must update your income for IDR plans every year. Miss it, and your payment jumps to the standard amount.

2. Ignoring U.S. tax filing rules.

You still have to file a U.S. tax return annually. Skipping it breaks tax compliance and can disrupt income verification for your repayment plan.

3. Overlooking how your spouse’s income is counted.

If you’re married filing jointly, your spouse’s income (even if earned abroad) can raise your AGI and your payment. Some borrowers file separately to manage this — but that comes with trade-offs.

4. Failing to cut state tax ties.

If you left a state like California or Virginia without ending residency properly, that state can still tax your income — inflating your AGI and, in turn, your loan payment.

5. Ignoring how interest accrues on $0 payments.

A $0 payment doesn’t mean your balance stops growing. Under most IDR plans, unpaid interest continues to accrue.

Before You Move Abroad (Quick Checklist)

Heading overseas with student loans? Run through this first:

✅ Understand the FEIE/IDR Rule.

Don’t expect a guaranteed $0 payment just because your AGI looks smaller on paper. Know how your servicer verifies income and that your total income before exclusions may be used.

✅ Assess FEIE and FTC implications.

Learn how the FEIE or FTC affects both your taxes and IDR payments. Servicers may request tax documents or alternative proof of income — plan for both scenarios.

✅ Update your contact info.

Make sure your loan servicer has your correct email, phone, and mailing address (ask if a foreign address is allowed).

✅ Keep a U.S. bank account open.

Most servicers still process payments through U.S. accounts. If you rely on a foreign bank, confirm accepted payment methods or wire options first.

✅ Budget for currency and transfer logistics.

Decide how you’ll make payments — online or via transfer — and factor in exchange rates and fees. Some servicers accept international transfers; others require USD payments from a domestic account.

✅ File your taxes every year. You’ll need a current return for IDR recertification, even if your FEIE wipes out your taxable income. Keeping your filings up to date also makes it easier to verify income automatically through the IRS data link.

✅ Time your IDR recertification wisely.

If you claim the FEIE, consider recertifying soon after your most recent tax return is fully processed and accurate. That timing can improve the odds your AGI will transfer correctly through the IRS data link, reducing the need for manual income verification that might include your excluded foreign income.

✅ Plan for data-sharing with your loan servicer.

Some servicers pull IRS data automatically; others require copies of tax returns or income verification. Decide in advance whether you’ll authorize data sharing with your servicer.

✅ Store every document. Keep digital copies of your tax return, Form 2555, pay stubs, and proof of residence — they’re gold if your file ever gets flagged for manual review.

Bottom Line

Moving abroad doesn’t erase your loans — it just changes how you manage them.

Your income-driven payment could drop if your AGI from the IRS data pull is accepted — but that outcome isn’t guaranteed. Depending on how your income is verified or what documentation is used, your excluded foreign earnings might still be considered in the calculation.

If you’re living or planning to live overseas, understand the rules, document everything, and stay ahead of deadlines.

Subscribe for student loan updates or book a consult with a CFP® who understands international borrowers.

Disclaimer: This article provides general information and should not be taken as personalized tax, legal, or financial advice. Rules change frequently, and your situation may vary. Consult a qualified student loan or tax professional before acting on this information.

FAQs: Student Loans and Living Abroad

No. There’s no law or program that automatically cancels your student debt after living abroad — that’s a myth. However, living overseas can lower your required payments if you qualify for an income-driven plan and report foreign income correctly.

Yes. Federal student loans remain your responsibility no matter where you live. The Department of Education can still collect through tax refunds or Social Security if you return, and your credit report remains active while you’re abroad.

Not safely. Missing payments can lead to default, wage garnishment (if you return to the U.S.), and long-term credit damage. Instead, apply for an IDR plan or a deferment if you qualify.

Yes, but it depends. Time spent abroad can count toward IDR forgiveness if you stay on an eligible plan and keep payments current. PSLF, on the other hand, requires qualifying employment.

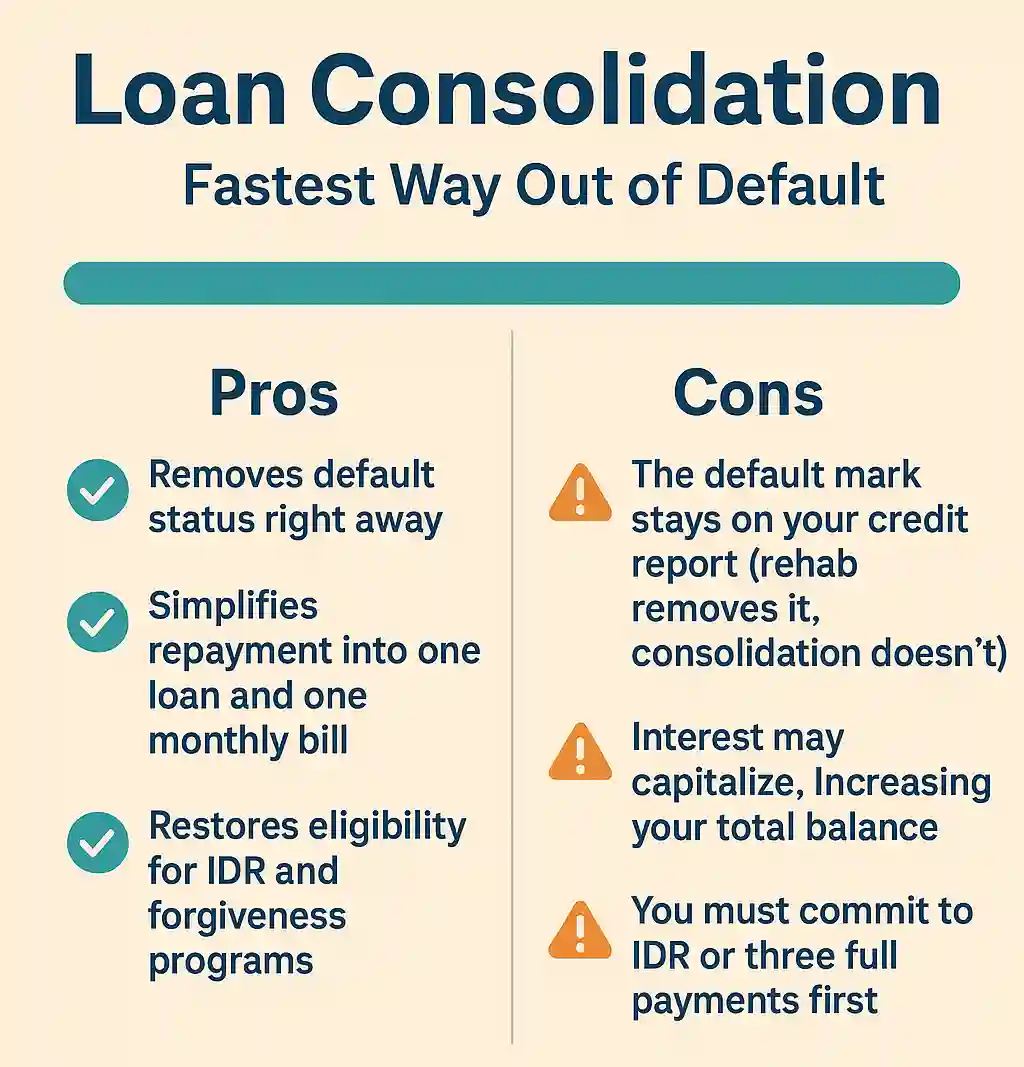

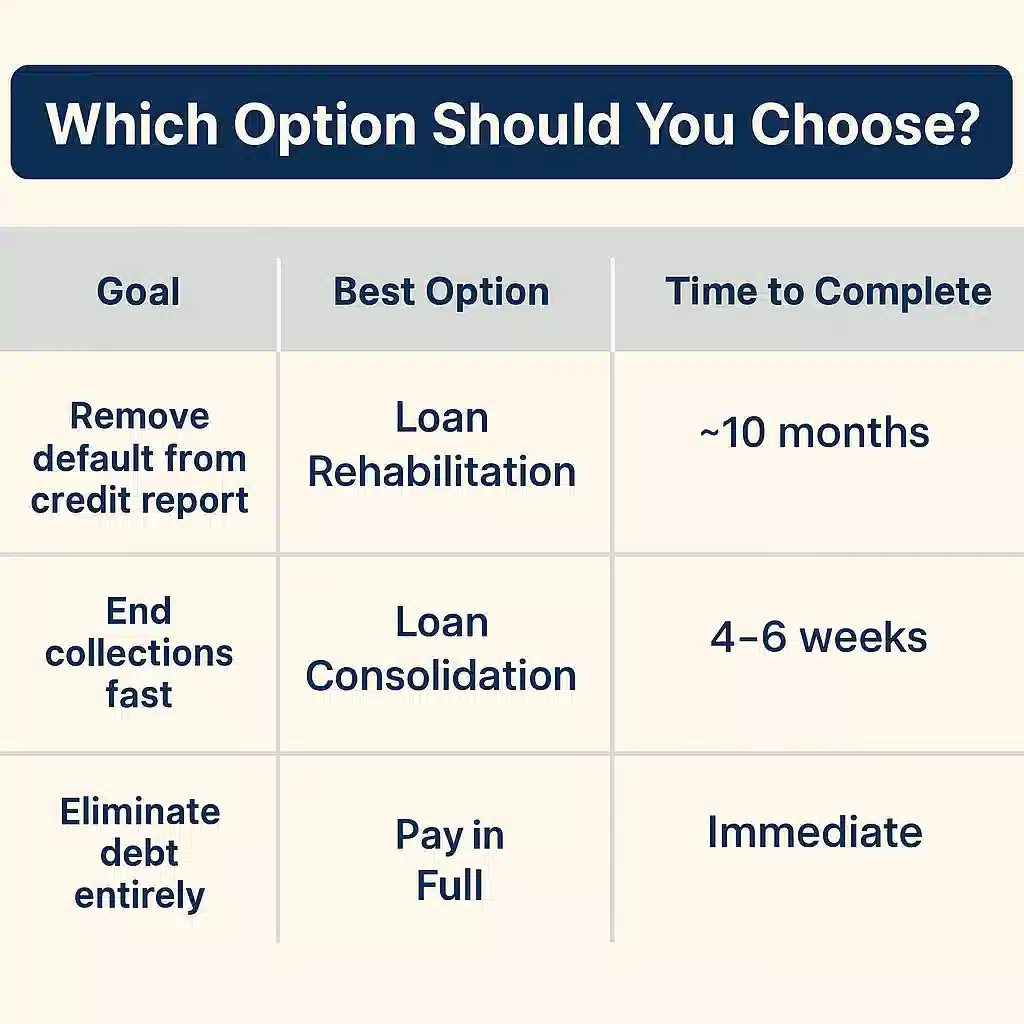

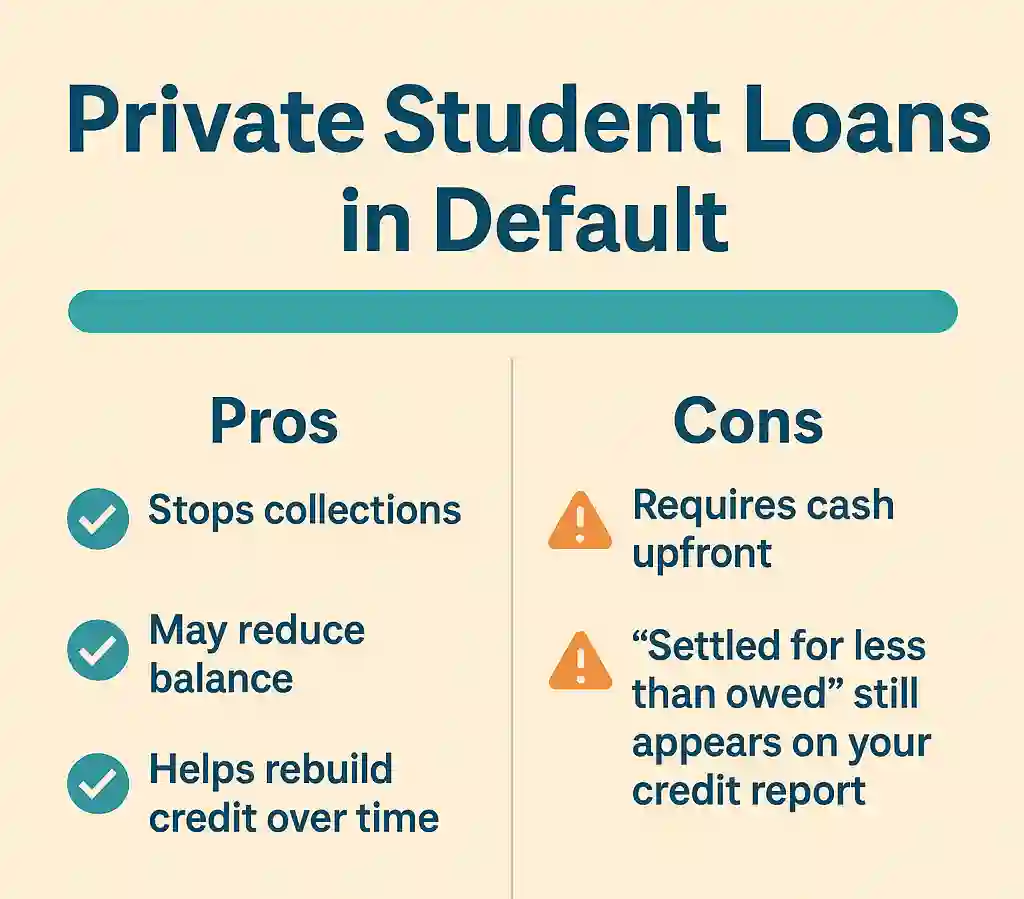

You can consolidate federal loans from anywhere, since it stays within the U.S. system. But refinancing through a private lender can be tricky — most lenders require a U.S. address, bank account, and credit history. Some expat-friendly lenders may still consider you, but it’s rare.

Pedro Gomez is the new Student Loan Sherpa and a Certified Financial Planner™ with over a decade of experience helping clients navigate complex financial decisions. He is the founder of Global Financial Plan, where he writes about international living, geoarbitrage, and strategies for retiring young, and also leads Brickell Financial Group, a registered investment advisory firm focused on accelerating financial freedom.

Pedro is the architect behind the “12 Levels of Financial Freedom” framework and blends student loan strategy with long-term planning, tax efficiency, and investing. His work is especially geared toward upwardly mobile professionals, entrepreneurs, and those looking to design a life beyond the default path.

Pedro is available for strategy sessions and press inquiries.