In light of recent developments at the Federal Trade Commission under the current administration — including staffing reductions and a temporary 2025 government shutdown — many observers and researchers are questioning whether the FTC’s Freedom of Information Act (FOIA) program is still functioning. The answer remains: yes — the FOIA program is still formally operational, but its capacity and responsiveness appear diminished under current conditions.

The FTC continues to administer FOIA through its Office of General Counsel (OGC), which processes all FOIA requests. As of the 2024 fiscal year, the FTC’s FOIA Unit comprised four attorneys, five government-information specialists, and one paralegal, with occasional support from contractors and other staff. In that year, the agency processed 1,919 requests (and 29 appeals), up from 1,812 in 2023. The agency’s publicly available “FOIA Handbook,” last updated in April 2025, continues to outline how requests should be submitted, what records are on the public record, and how exemptions are applied.

The FTC’s website still provides instructions for submitting a FOIA request via its online portal, email, fax, or mail. That means requests remain legally eligible — including those related to for-profit colleges, student loan servicers, institutional behavior, complaints, or decision-making memos.

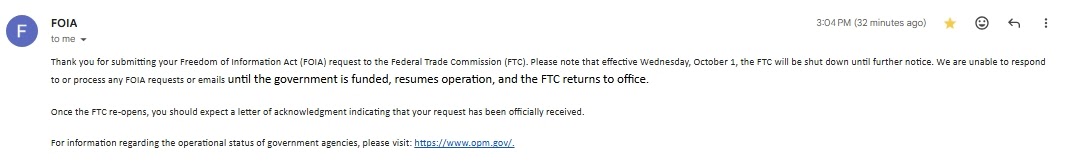

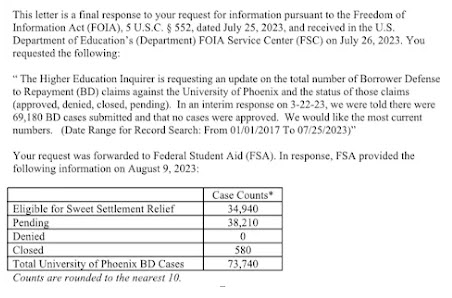

However, HEI’s own experience in 2025 highlights some of the challenges with the FTC’s current FOIA responsiveness. In January 2025, we submitted a FOIA request asking for a record of complaints against the University of Phoenix. Beyond an automated message, there was no response. In August 2025, we submitted another FOIA request asking for complaints against a company that dealt with student loans; in that case, not even an automated acknowledgment was received. On November 30, 2025, we received an automated response to our FOIA request about AidVantage, a student loan servicer and subsidiary of Maximus. While we did receive a reply, it reflected a stale message stating they would respond after the government reopened — even though the government had reopened on November 13.

These examples illustrate that while FOIA is formally operational, actual responsiveness has deteriorated. For years, HEI had a good relationship with the FTC, obtaining critical information for a number of investigations in a timely manner. It remains to be seen whether that reliability can be restored.

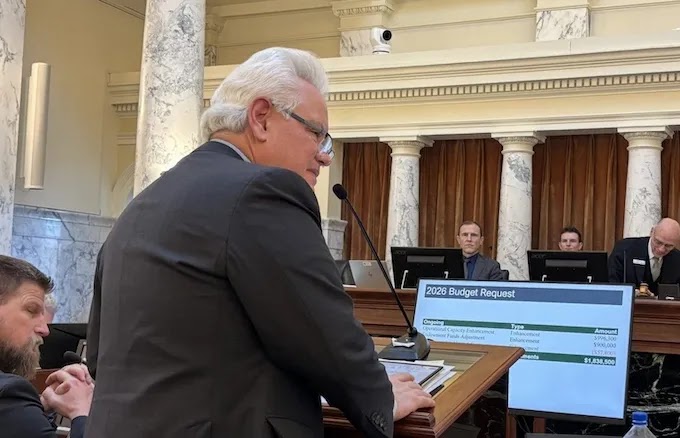

Compounding the issue are broader staffing and operational changes at the FTC. In testimony before Congress in May 2025, FTC Chair Andrew N. Ferguson reported that the agency began FY 2025 with about 1,315 personnel but had reduced to 1,221 full-time staff, with plans to potentially reduce further to around 1,100 — the lowest level in a decade. These staffing reductions coincide with scaled-back discretionary activities, such as rulemaking, public guidance publishing, and outreach. During the October 2025 lapse in government funding, the FTC announced that FOIA requests could still be submitted but would not be processed until appropriations resumed.

For researchers, journalists, and advocates — including those pursuing records related to for-profit colleges, student loan servicers, regulatory decisions, or historical investigations — FOIA remains a legally viable tool. The path is open, though response times are slower, staff resources are constrained, and releases may be more limited, especially for sensitive or exempt material.

Sources

Congressional budget testimony on FTC staffing and budget: https://www.congress.gov/119/meeting/house/118225/witnesses/HHRG-119-AP23-Wstate-FergusonA-20250515.pdf

FTC FOIA Handbook (April 2025): https://www.ftc.gov/system/files/ftc_gov/pdf/FOIA-Handbook-April-2025.pdf

FTC 2024 Chief FOIA Officer Report (staffing, request volume): https://www.ftc.gov/system/files/ftc_gov/pdf/chief-foia-officer-report-fy2024.pdf

FTC website instructions for submitting FOIA requests: https://www.ftc.gov/foia/make-foia-request

FTC 2025 shutdown plan showing FOIA processing paused during funding lapse: https://www.ftc.gov/ftc-is-closed

Reporting on FTC removal of business-guidance blogs in 2025: https://www.wired.com/story/federal-trade-commission-removed-blogs-critical-of-ai-amazon-microsoft/