Join our zero2eight Substack community for more discussion about the latest news in early care and education. Sign up now.

Hunger is on the rise for the early care and education workforce, according to recent research from the Stanford Center on Early Childhood, and signs suggest the challenge is unlikely to improve in the short term.

In June, 58% of early care and education providers surveyed by the RAPID Survey Project at Stanford said they were experiencing hunger, which researchers measured using six questions about food insecurity developed by the U.S. Department of Agriculture. These providers, who span a variety of roles and settings, are not just dealing with sticker shock at the grocery store; they are skipping meals, eating smaller portions to stretch food supplies further, and going hungry because they’ve run out of money to purchase food.

The RAPID Survey Project measured hunger using six food security criteria developed by the U.S. Department of Agriculture:

- The food that we bought just didn’t last, and we didn’t have money to get more.

- We couldn’t afford to eat balanced meals.

- Did you or other adults in your household ever cut the size of your meal or skip meals because there wasn’t enough money for food?

- If yes, how often did this happen?

- Did you ever eat less than you felt you should because there wasn’t enough money for food?

- Were you ever hungry but didn’t eat because there wasn’t enough money for food?

RAPID has charted provider food insecurity for the past four years. Rates of hunger held steady between 20% and 30% from summer 2021 until early 2024, then began rising precipitously.

Phil Fisher, director of the Stanford Center on Early Childhood, said the status quo rates of provider hunger were “unacceptable to begin with,” but that this recent spike is both “alarming” and “concerning.”

“The early care and education workforce is incredibly vulnerable to economic trends,” Fisher said, explaining the rise. “Part of it is just how close to abject poverty many [educators] are.”

Indeed, early educators earn a median wage of $13.07 per hour, making it one of the lowest-paid professions in the United States. An estimated 43% of the workforce relies on public benefits, such as Medicaid and food stamps, to get by.

So when prices go up, early educators are among the first to feel the effects, and lately, food prices have done nothing but climb. The cost of groceries has increased almost 30% since February 2020.

“Food is very expensive,” said Isabel Blair, a home-based child care provider of almost 20 years who recently decided to close her program in Michigan. “It’s hard for families earning minimum wage to cover their basic needs — housing, child care and food.”

Blair has noticed price inflation among eggs and produce, in particular. Both are staples in an early education program.

“You go to the grocery store, and the fresh vegetables are very expensive. For a tomato, you pay like three bucks. Or a dozen eggs, you play close to $4 now,” she said. “Feeding the children, you have to provide breakfast, a snack and lunch. Some programs offer dinner. Add those up, and it’s very costly.”

In the RAPID survey, providers shared written responses to open-ended questions, and some highlighted how high grocery prices are affecting their own families.

“We’re skipping meals so the kids can eat,” a teacher in Colorado said. “Grocery prices are through the roof.”

“Grocery bills continue to rise and we are having to cut back on what we buy and redo our menu at home to be able to afford the same amount of food we were buying just months ago…” wrote a center director in Washington.

“[My biggest concern right now is that] we don’t go hungry in the street someday,” a teacher at a center-based program in Georgia wrote.

A center director in Indiana said the “cost of groceries is going up and I can’t afford enough food … to last the entire month. We have to skimp on meals or bring leftovers from work home for the kids to eat.”

“Keeping food in the house and meeting our nutritional needs as a family [are my biggest concerns],” wrote a home-based provider in Ohio.

Cristi Carman, director of the RAPID Survey Project, said the difficult choices providers must make, between buying more groceries or paying off a bill, is “really, really devastating.” Carman and Fisher separately noted that it becomes harder for caregivers to provide a nurturing, high-quality environment for kids when their stomachs are growling and they’re worried about how to put food on the tables for their own families before their next paycheck hits.

“That’s not humane circumstances for individuals in any role, especially when they’re caring for the youngest children,” Carman said. “They’re not operating under the best set of circumstances. They’re operating at reduced need.”

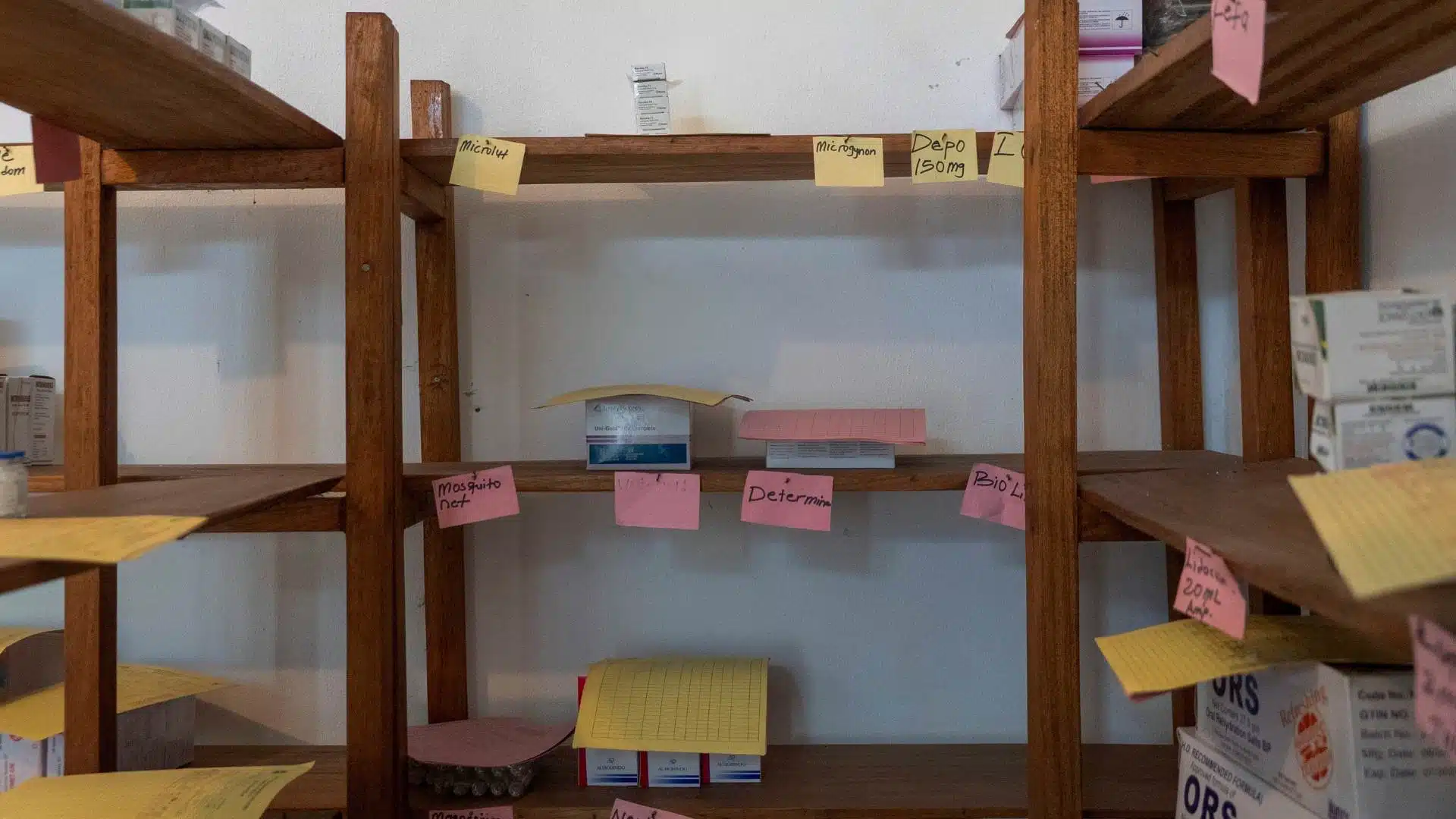

What’s more, Fisher said, is that early care and education providers often aren’t just buying groceries for themselves, but for the kids in their programs as well. (Rising costs have hit unlicensed family, friend and neighbor providers who care for millions of children from birth to age 5 in the U.S. especially hard, because while they are technically eligible, many remain excluded from the federal food program for child care providers.) So when providers are going hungry, it usually means the kids they’re serving are affected too. Maybe fresh fruits and vegetables are replaced with canned items, or proteins are replaced with carbs. Corner-cutting becomes unavoidable.

Despite the severity of food insecurity among providers, grocery prices are not expected to stabilize anytime soon, with the Trump administration’s tariffs forcing up the cost of imported foods. Meanwhile, the Supplemental Nutrition Assistance Program, which helps low-income households offset the cost of food, was disrupted during the government shutdown this fall, leaving many recipients without benefits for weeks. RAPID researchers have not yet finished analyzing survey data from that period, but Fisher acknowledged it may only show a worsening situation.

“We’re not expecting these things to get better in the short term,” Fisher said. “If anything it will either reach a ceiling or continue to spiral.”

Did you use this article in your work?

We’d love to hear how The 74’s reporting is helping educators, researchers, and policymakers. Tell us how