The Department’s 90-10 rule, created by Congress, requires for-profit colleges to obtain at least ten percent of their revenue from sources other than taxpayer-funded federal student grants and loans, or else — if they flunk two years in a row — lose eligibility for federal aid. The purpose is to remove from federal aid those schools of such poor quality that few students, employers, or scholarship programs would put their own money into them.

For decades, low quality schools have been able to avoid accountability through a giant loophole: only Department of Education funding counted on the federal side of the 90-10 ledger, while other government funding, including GI Bill money from the VA, and tuition assistance for active duty troops and their families from the Pentagon, counted as non-federal. That situation was particularly bad because it motivated low-quality predatory schools, worried about their 90-10 ratios, to aggressively target U.S. veterans and service members for recruitment.

After years of efforts by veterans organizations and other advocates to close the loophole, Congress in 2021 passed, on a bipartisan basis, and President Biden signed, legislation that appropriately put all federal education aid, including VA and Defense Department money, on the federal side of the ledger.

The Department was required by the new law to issue regulations specifying in detail how this realignment would work, and the Department under the Biden administration did so in 2022, after engaging in a legally-mandated negotiated rulemaking that brought together representatives of relevant stakeholders. In an unusual development, that rulemaking actually achieved consensus among the groups at the table, from veterans organizations to the for-profit schools themselves, on what the final revised 90-10 rule should be.

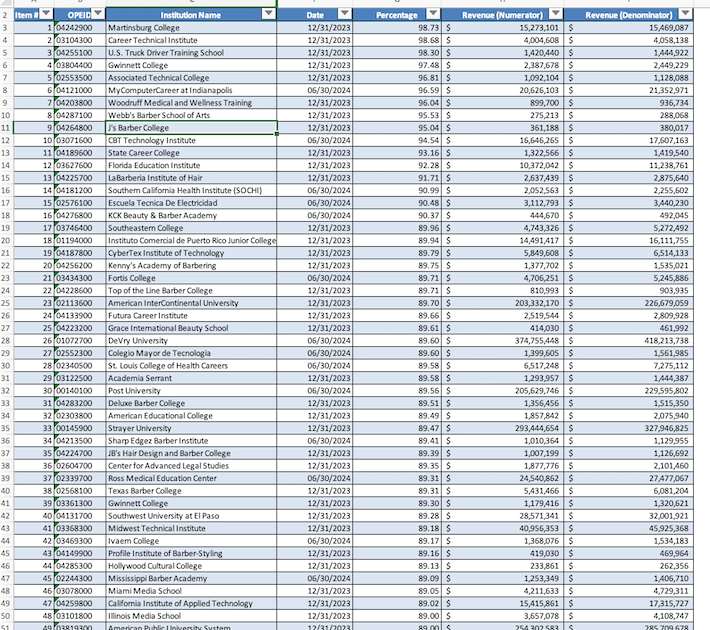

The new rule took effect in 2023, and when the Department released the latest 90-10 calculations, for the 2023-24 academic year, sixteen for-profit colleges had flunked, compared with just five the previous year. These were mostly smaller schools, led by West Virginia’s Martinsburg College, which got 98.73 percent of its revenue from federal taxpayer dollars, and Washington DC’s Career Technical Institute, which reported 98.68 percent. Another 36 schools, including major institutions such as DeVry University, Strayer University, and American Public University, came perilously close to the line, at 89 percent or higher.

The education department last week altered the calculation by effectively restoring an old loophole that allowed for-profit colleges to use revenue from programs that are ineligible for federal aid to count on the non-federal side. That loophole was expressly addressed, via a compromise agreement, after Department officials discussed the details with representatives of for-profit colleges, during the 2022 negotiated rulemaking meetings.

All the flunking or near-flunking schools can now get a new, potentially more favorable, calculation of their 90-10 ratio under the Trump administration’s re-interpretation of the rule.

As it has done multiple times over its first six months, the Trump Department of Education, under Secretary Linda McMahon, has again taken a step that allows poor-quality predatory for-profit colleges to rip off students and taxpayers.