by Jill Barshay, The Hechinger Report

January 19, 2026

Lynette Duncan didn’t expect to spend 20 hours over the past two weeks digging through a mothballed computer system, trying to retrieve admissions data from 2019.

Duncan is the director of institutional research at John Brown University, a small Christian university in northwest Arkansas, an hour’s drive from Walmart’s headquarters. She runs a one-person office that handles university data collections and analyses, both for internal use and to meet government mandates. Just last year, she spent months collecting and crunching new data to comply with a new federal rule requiring that colleges show that their graduates are prepared for good jobs.

Then, in mid-December, another mandate abruptly arrived — this one at the request of President Donald Trump. Colleges were ordered to compile seven years of admissions data, broken down by race, sex, grades, SAT or ACT scores, and family income.

“It’s like one more weight on our backs,” Duncan said. “The workload – it’s not fun.”

Related: Our free weekly newsletter alerts you to what research says about schools and classrooms.

John Brown University is one of almost 2,200 colleges and universities nationwide now scrambling to comply by March 18 with the new federal reporting requirement, formally known as the Admissions and Consumer Transparency Supplement, or ACTS. By all accounts, it’s a ton of work, and at small institutions, the task falls largely on a single administrator or even the registrar. Failure to submit the data can bring steep fines and, ultimately, the loss of access to federal aid for students.

After the Supreme Court’s 2023 decision banning affirmative action in college admissions, the Trump administration suspected that colleges might covertly continue to give racial preferences. To police compliance, the White House directed the Department of Education to collect detailed admissions data from colleges nationwide.

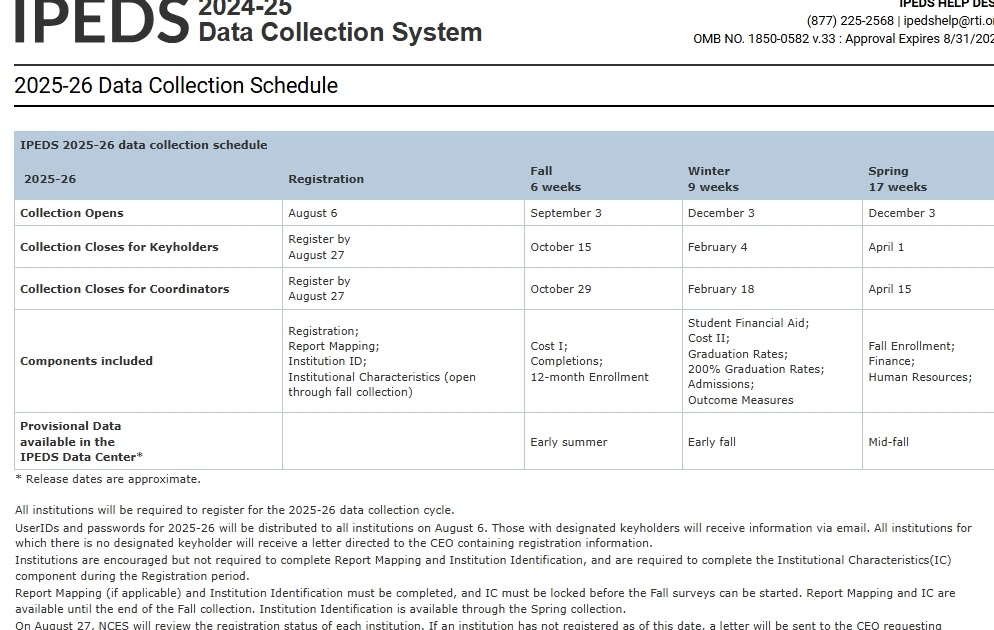

The data collection was unusual not only in its scope, but also in its speed. Federal education data collections typically take years to design, with multiple rounds of analysis, technical review panels, and revisions. This one moved from announcement to launch in a matter of months.

A rush job

One tiny indication that this was a rush job is in the Federal Register notice. Both enforce and admissions are misspelled in a proposal that’s all about admissions enforcement. Those words are spelled “admssions” and “enforece.”

A December filing with the Office of Management and Budget incorrectly lists the number of institutions that are subject to the new data collection. It is nearly 2,200, not 1,660, according to the Association for Institutional Research, which is advising colleges on how to properly report the data. Community colleges are exempt, but four-year institutions with selective admissions or those that give out their own financial aid must comply. Graduate programs are included as well. That adds up to about 2,200 institutions.

Related: Inaccurate, impossible: Experts knock new Trump plan to collect college admissions data

In another filing with the Office of Management and Budget, the administration disclosed that none of the five remaining career Education Department officials with statistical experience had reviewed the proposal, including Matt Soldner, the acting commissioner of the National Center for Education Statistics. Most of the department’s statistical staff were fired earlier this year as a first step to eliminating the Education Department, one of Trump’s campaign promises. RTI International, the federal contractor in North Carolina that already manages other higher education data collections for the Education Department, is also handling the day-to-day work of this new college admissions collection.

During two public comment periods, colleges and higher-education trade groups raised concerns about data quality and missing records, but there is little evidence those concerns substantially altered the final design. One change expanded the retrospective data requirement from five to six years so that at least one cohort of students would have a measurable six-year graduation rate. A second relieved colleges of the burden of making hundreds of complex statistical calculations themselves, instead instructing them to upload raw student data to an “aggregator tool” that would do all the math for them.

The Trump administration’s goal is to generate comparisons across race and sex categories, with large gaps potentially triggering further scrutiny.

Missing data

The results are unlikely to be reliable, experts told me, given how much of the underlying data is missing or incomplete. In a public comment letter, Melanie Gottlieb, executive director of the American Association of Collegiate Registrars and Admissions Officers, warned that entire years of applicant data may not exist at many institutions. Some states advise colleges to delete records for applicants who never enrolled after a year. “If institutions are remaining compliant with their state policies, they will not have five years of data,” Gottlieb wrote.

The organization’s own guidance recommends that four-year colleges retain admissions records for just one year after an application cycle. One reason is privacy. Applicant files contain sensitive personal information, and purging unneeded records reduces the risk of exposing this data in breaches.

In other cases, especially at smaller institutions, admissions offices may offload applicant data simply to make room for new student records. Duncan said John Brown University has all seven years of required data, but a switch to a new computer system in 2019 has made it difficult to retrieve the first year.

Even when historical records are available, key details may be missing or incompatible with federal requirements, said Christine Keller, executive director of the Association for Institutional Research, which previously received a federal contract to train college administrators on accurate data collection until DOGE eliminated it. (The organization now receives some private funds for a reduced amount of training.)

Standardized test scores are unavailable for many students admitted under test-optional policies. The department is asking colleges to report an unweighted grade-point average on a four-point scale, even though many applicants submit only weighted GPAs on a five-point scale. In those cases, and there may be many of them, colleges are instructed to report the GPA as “unknown.”

Some students decline to report their race. Many holes are expected for family income. Colleges generally have income data only for students who completed federal financial-aid forms, which many applicants never file.

Ellen Keast, a spokeswoman for the Education Department, said in an email, “Schools are not expected to provide data they don’t have.” She added, “We know that some schools may have missing data for some data elements. We’ll review the extent of missing data before doing further calculations or analyses.”

Male or female

Even the category of sex poses problems. The Education Department’s spreadsheet allows only two options: male or female. Colleges, however, may collect sex or gender information using additional categories, such as nonbinary.

“That data is going to be, in my estimation, pretty worthless when it comes to really showing the different experiences of men and women,” Keller said. She is urging the department to add a “missing” option to avoid misleading results. “I think some people in the department may be misunderstanding that what’s needed is a missing-data option, not another sex category.”

The new “aggregator tool” itself is another source of anxiety. Designed to spare colleges from calculating quintile buckets for grades and test scores by race and sex, it can feel like a black box. Colleges are supposed to fill rows and rows of detailed student data into spreadsheets and then upload the spreadsheets into the tool. The tool generates pooled summary statistics, such as the number of Black female applicants and admitted students who score in the top 20 percent at the college. Only the aggregated data will be reported to the federal government.

At John Brown University, Duncan worries about what those summaries might imply. Her institution is predominantly white and has never practiced affirmative action. But if high school grades or test scores differ by race — as they often do nationwide — the aggregated results could suggest bias where none was intended.

“That’s a concern,” Duncan said. “I’m hopeful that looking across multiple years of data, it won’t show that. You could have an anomaly in one year.”

The problem is that disparities are not anomalies. Standardized test scores and academic records routinely vary by race and sex, making it difficult for almost any institution to avoid showing gaps.

A catch-22 for colleges

The stakes are high. In an emailed response to my questions, the Education Department pointed to Trump’s Aug. 7 memorandum, which directs the agency to take “remedial action” if colleges fail to submit the data on time or submit incomplete or inaccurate information.

Under federal law, each violation of these education data-reporting requirements can carry a fine of up to $71,545. Repeated noncompliance can ultimately lead to the loss of access to federal student aid, meaning students could no longer use Pell Grants or federal loans to pay tuition.

That leaves colleges in a bind. Failing to comply is costly. Complying, meanwhile, could produce flawed data that suggests bias and invites further scrutiny.

The order itself contradicts another administration goal. President Trump campaigned on reducing federal red tape and bureaucratic burden. Yet ACTS represents a significant expansion of paperwork for colleges. The Office of Management and Budget estimates that each institution will spend roughly 200 hours completing the survey this year — a figure that higher-education officials say may be an understatement.

Duncan is hoping she can finish the reporting in less than 200 hours, if there are no setbacks when she uploads the data. “If I get errors, it could take double the time,” she said.

For now, she is still gathering and cleaning old student records and waiting to see the results… all before the March 18 deadline.

Contact staff writer Jill Barshay at 212-678-3595, jillbarshay.35 on Signal, or [email protected].

This story about college admissions data was produced by The Hechinger Report, a nonprofit, independent news organization focused on inequality and innovation in education. Sign up for Proof Points and other Hechinger newsletters.

This <a target=”_blank” href=”https://hechingerreport.org/proof-points-admissions-data-collection-strains-colleges/”>article</a> first appeared on <a target=”_blank” href=”https://hechingerreport.org”>The Hechinger Report</a> and is republished here under a <a target=”_blank” href=”https://creativecommons.org/licenses/by-nc-nd/4.0/”>Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License</a>.<img src=”https://i0.wp.com/hechingerreport.org/wp-content/uploads/2018/06/cropped-favicon.jpg?fit=150%2C150&ssl=1″ style=”width:1em;height:1em;margin-left:10px;”>

<img id=”republication-tracker-tool-source” src=”https://hechingerreport.org/?republication-pixel=true&post=114400&ga4=G-03KPHXDF3H” style=”width:1px;height:1px;”><script> PARSELY = { autotrack: false, onload: function() { PARSELY.beacon.trackPageView({ url: “https://hechingerreport.org/proof-points-admissions-data-collection-strains-colleges/”, urlref: window.location.href }); } } </script> <script id=”parsely-cfg” src=”//cdn.parsely.com/keys/hechingerreport.org/p.js”></script>