They call it a “path to opportunity,” but for millions of students and their families, American higher education is just Flirtin’ with Disaster—a gamble with long odds and staggering costs. Borrowers bet their future on a credential, universities gamble with public trust and private equity, and the system as a whole plays chicken with economic and social collapse. Cue the screeching guitar of Molly Hatchet’s 1979 Southern rock anthem, and you’ve got a fitting soundtrack to the dangerous dance between institutions of higher ed and the consumers they so aggressively court.

The Student as Collateral

For the last three decades, higher education in the United States has increasingly behaved like a high-stakes poker table, only it’s the students who are holding a weak hand. Underfunded public colleges, predatory for-profits, and tuition-hiking private universities all promise upward mobility but deliver it only selectively. The rest? They leave the table with debt, no degree, or both.

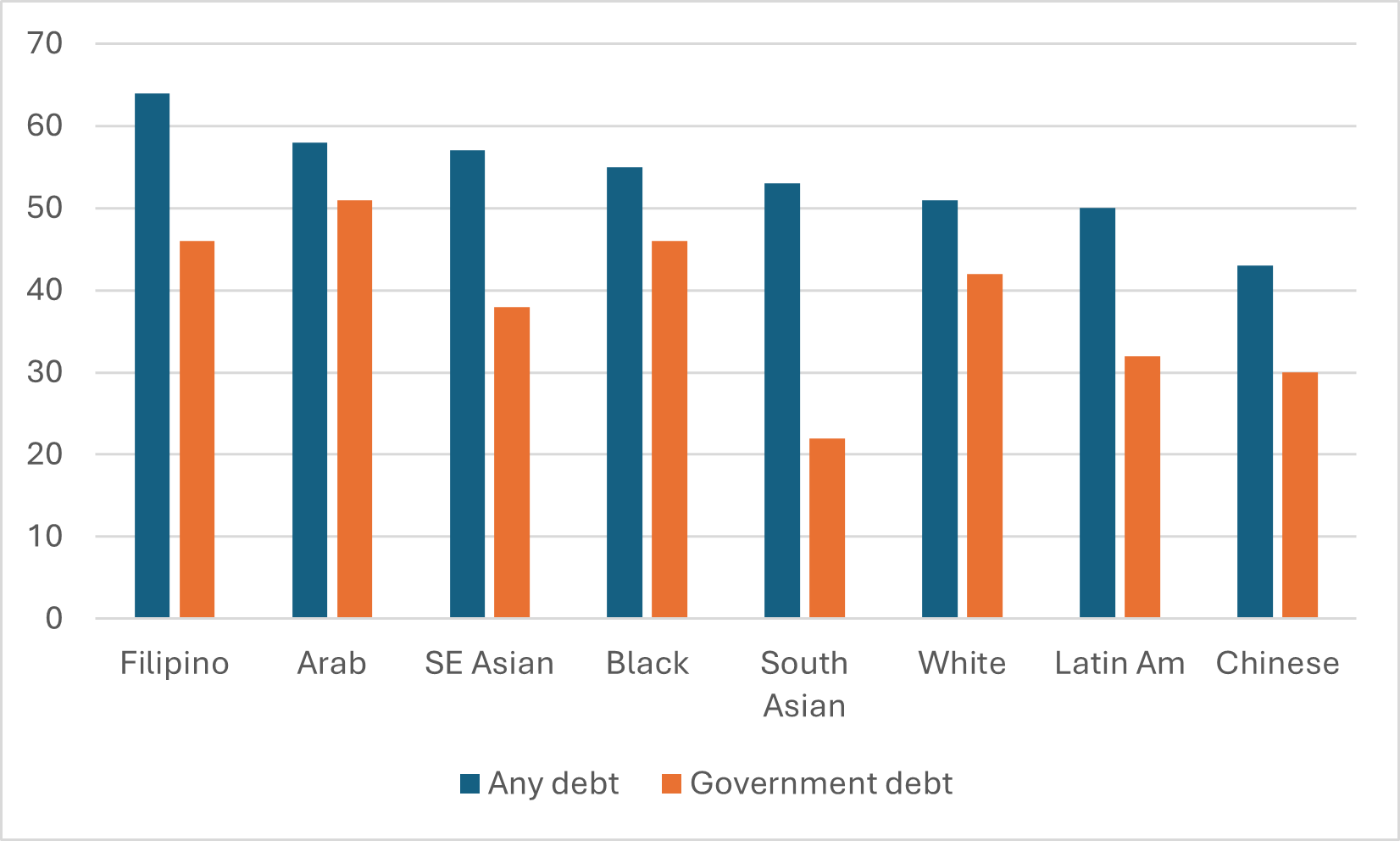

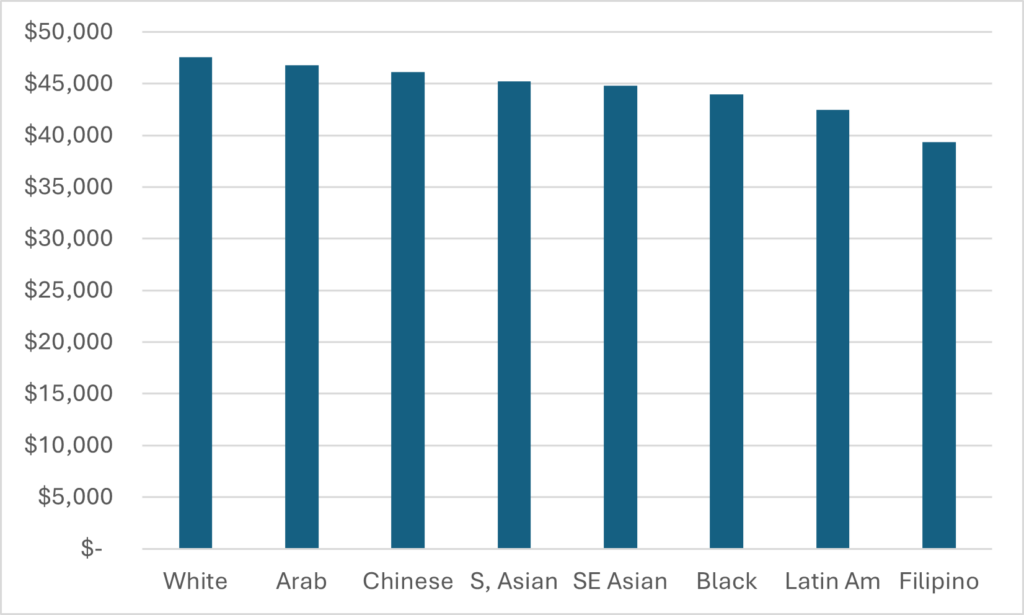

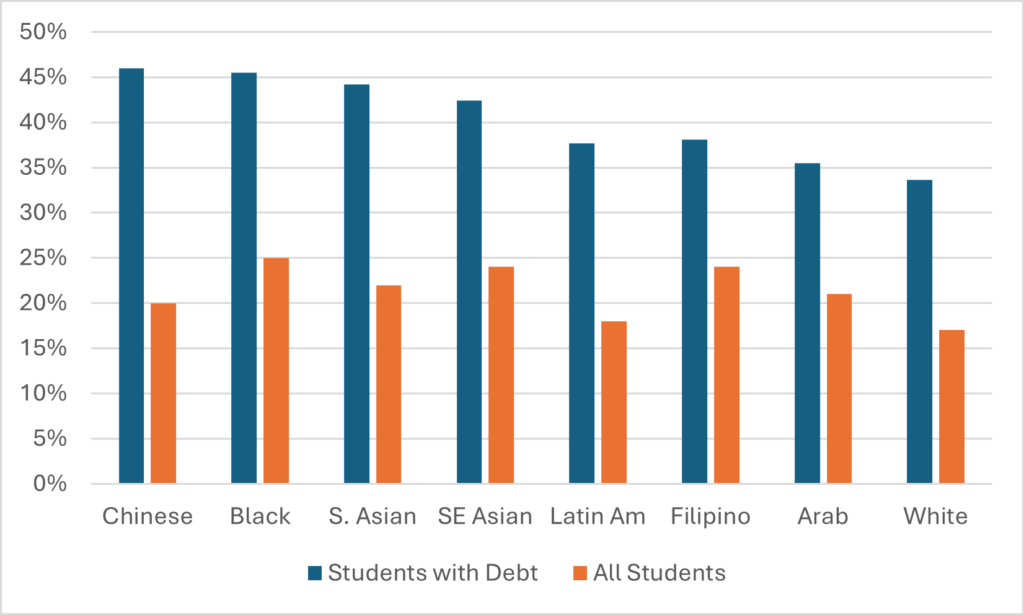

Colleges market dreams, but they sell debt. Americans now owe more than $1.7 trillion in student loans. And while some elite schools can claim robust return-on-investment, most institutions below the top tiers produce increasingly shaky value propositions—especially for working-class, first-gen, and BIPOC students. For them, education is often less an elevator to the middle class than a trapdoor into a lifetime of wage garnishment and diminished credit.

Institutional Recklessness

Universities themselves are no saints in this drama. Fueled by financial aid dollars, college leaders have expanded campuses like land barons—building luxury dorms, bloated athletic programs, and administrative empires. Meanwhile, instruction is increasingly outsourced to underpaid adjuncts, and actual student support systems are skeletal at best.

The recklessness isn’t limited to for-profits like Corinthian Colleges, ITT Tech, and the Art Institutes, all of which collapsed under federal scrutiny. Even brand-name nonprofits—think USC, NYU, Columbia—have been exposed for enrolling students into costly, often ineffective online master’s programs in partnership with edtech firms. The real product wasn’t the degree—it was the debt.

A Nation at the Brink

From community colleges to research universities, institutions are now being pushed to their financial and ethical limits. The number of colleges closing or merging has skyrocketed, especially among small private colleges and rural campuses. Layoffs, like those at Southern New Hampshire University and across public systems in Pennsylvania, Oregon, and West Virginia, show that austerity is the new norm.

But the real disaster is systemic. The American college promise—that hard work and higher ed will lead to security—is unraveling in real time. With declining enrollments, aging infrastructure, and increasing political pressure to defund or control curriculum, many schools are shifting from public goods to privatized risk centers. Even state flagship universities now behave more like hedge funds than educational institutions.

Consumers or Victims?

One of the cruelest ironies is that students are still told they are “consumers” who should “shop wisely.” But education is not like buying a toaster. There’s no refund if your college closes. There’s no protection if your degree is devalued. And there’s no bankruptcy for most student loan debt. Even federal forgiveness efforts—like Borrower Defense or Public Service Loan Forgiveness—are riddled with bureaucratic landmines and political sabotage.

In this asymmetric market, the house almost always wins. Institutions keep the revenue. Third-party contractors keep their profits. Politicians collect campaign checks. And the borrowers? They’re left flirtin’ with disaster, hoping the system doesn’t collapse before they’ve paid off the last dime.

No Exit Without Accountability

There’s still time to change course—but it will require radical rethinking. That means:

-

Holding institutions and executives accountable for false advertising and financial harm.

-

Reining in tuition hikes and decoupling higher ed from Wall Street’s expectations.

-

Fully funding community colleges and public universities to serve as real social infrastructure.

-

Expanding debt cancellation—not just piecemeal forgiveness—for those most harmed by a failed system.

-

Ending the exploitation of adjunct labor and restoring the academic mission.

Otherwise, higher education in the U.S. will continue on its reckless path, a broken-down system blasting its anthem of denial as it speeds toward the edge.

As the song goes:

“I’m travelin’ down the road and I’m flirtin’ with disaster… I got the pedal to the floor, my life is runnin’ faster.”

So is the American student debt machine—and we’re all strapped in for the ride.

Sources:

-

U.S. Department of Education, Federal Student Aid Portfolio

-

“The Trillion Dollar Lie,” Student Borrower Protection Center

-

The Century Foundation, “The High Cost of For-Profit Colleges”

-

Inside Higher Ed, Chronicle of Higher Education, Higher Ed Dive

-

National Center for Education Statistics

-

Molly Hatchet, Flirtin’ with Disaster, Epic Records, 1979