Dive Brief:

- Amid volatile markets and shifting investment strategies, big U.S. university endowments posted their second straight year of double-digit gains, according to an analysis from TIFF Investment Management.

- Endowments worth over $1 billion that have reported earnings so far made average returns of 11.5% in fiscal 2025, TIFF found. That’s on top of 11.2% average annual returns experienced sectorwide the previous year, according to the National Association of College and Business Officers-Commonfund endowment study.

- The strong earnings from college endowments come as Republicans aim to convert more of those funds into government revenue. “The Endowment Tax is coming,” the TIFF report noted.

Dive Insight:

Of the colleges that have reported their endowment earnings, the University of Wisconsin-Madison posted the highest return rate at 16.2%, followed by one of the University of California’s fund pools (15.8%) and the University of Michigan (15.5%).

For now, endowments have enjoyed strong returns and minimal, if any, federal taxes. The TIFF report attributed strong growth in fiscal 2025 — which ended in the summer for universities that recently reported — to outperforming private investments, such as in private equity and venture capital. Within private equity, investments in growth and pre-IPO companies in particular helped boost earnings.

For example, the Massachusetts Institute of Technology’s endowment — the top-performing among a group of elite colleges that also includes the Ivy League and Stanford University, with a return rate of 14.8% — had a little over a third of its assets in private equity, according to TIFF. University of Michigan had 9% in private equity and 28% in venture capital.

Endowment returns were also helped along by strong performances in both equities and bonds in what TIFF described as “an unusual year,” with both safer and higher-risk securities yielding returns amid broad economic concerns. International equities, artificial intelligence-related stocks, like Nvidia, and other diversifying investments such as gold also gave endowments a lift, TIFF said.

Endowment returns will face new pressure in 2026. The massive spending bill signed by President Donald Trump this summer is set to raise taxes next year on the richest private university endowments by multiple percentage points.

The current endowment tax — a flat rate of 1.4% enacted in 2017 — only applies to the wealthiest few dozen endowments in the country.

The spending bill creates a tiered tax system for colleges with 3,000 or more tuition-paying students that starts at 1.4% on returns for endowments valued at $500,000 to $749,999 per student. It then jumps to 4% and 8% based on endowment assets per student.

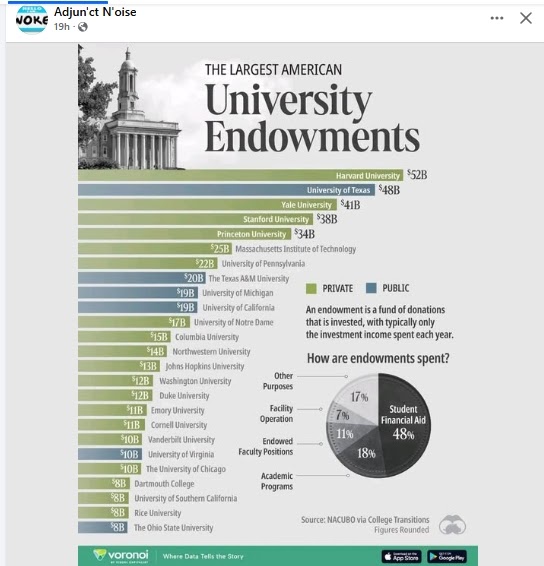

For the largest endowments, that translates into a tax bill of many millions of dollars per year. Harvard University, for example, anticipates it will pay $300 million a year to the government, CFO Ritu Kalra said in October. That compares to $44 million in taxes and other fees in fiscal 2024.

“That means hundreds of millions of dollars that will not be available to support financial aid, research, and teaching,” Kalra said in an official Q&A following the release of the university’s annual financials.

Yale University President Maurie McInnis said in July the tax will cost the institution around $280 million in its first year and likely more after that.

Even universities with smaller tax bills are also anticipating financial pain.

In July, Washington University in St. Louis’ leader cited in part an estimated $37 million in additional costs from the new taxes in explaining the need for budget measures. WashU has laid off 316 staffers and eliminated another 198 unfilled positions since March.