In most larger UK providers of higher education, the 2023–24 financial year ended on 31 July 2024.

Five months and two weeks after this date (so, on or before 14 January 2025) providers are obliged to have published (and communicated to regulators) audited financial statements for that year.

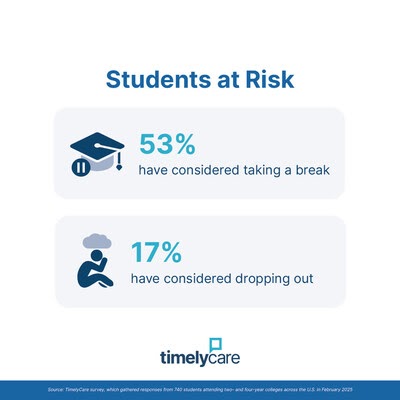

I’ve got a list of 160 large, well known, providers of higher education who should, by now, have made this disclosure – 43 of them are yet to do so. Of the 117 that have, just 15 (under 13 per cent) posted a deficit for that financial year (to be fair, this includes eight providers in Wales, where the deadline – for bilingual accounts – is the end of the month). This was as of the data of publication, there’s been a few more been discovered since then and I have added some to the charts below.

If you’ve been aware of individual providers, mission groups, representative bodies, trade unions, regulators, and politicians coming together to make the case that the sector is severely underfunded this may surprise you. If you work in an institution that is curtailing courses, making staff redundant, and undergoing the latest in a long series of cost-cutting exercises, the knowledge that your university has posted a surplus may make you angry.

But these results are not surprising, and a surplus should not make you angry (there are plenty of other reasons to be angry…) Understanding what an annual account is for, what a surplus is, why a university will pull out all of the stops to post a surplus, and what are the more alarming underpinning signals that we should be aware of will help you understand why we have what – on the face of it – feels like a counter-intuitive position in university finances.

Why are so many results missing?

There’s a range of reasons why a provider may submit accounts late – those who are yet to publish will already be deep in conversation with regulators about the issues that may have caused what is, technically, a breach of a regulatory condition. In England, this is registration condition E3. which is underpinned by the accounts direction.

If you are expecting regulators to get busy issuing fines or sanctions for late submissions – you should pause. There’s a huge problem with public sector audit capacity in the UK – the big players have discrete teams that move on an annual cycle between higher education, NHS, and local government audit. You don’t need to have read too much into public finances to know that our councils are under serious pressure right now – and this pressure results in audit delays, hitting the same teams who will be acting as external university auditors.

That’s one key source of delay. The other would be the complexities within university annual accounts, and university finances more generally, that offer any number of reasons why the audit signoff might happen later than hoped.

To be clear, very few of these reasons are going to be cheerful ones. If a provider has yet to publish its accounts because they have not signed off their accounts, it is likely to be engaging with external auditors about the conditions under which they will sign off accounts.

To give one example of what might happen – a university has an outstanding loan with a covenant attached to it based on financial performance (say, a certain level of growth each year). In 2023–24, it did not reach this target, so needs to renegotiate the covenant, which may make repayments harder (or spread out over a longer period). The auditor will need to wait until this is settled before it signs off the accounts – technically if you are in breach of covenant the whole debt is repayable immediately, something which would make you fail your going concern test.

We’ve covered covenants on the site before – a lender of whatever sort will offer finance at an attractive rate provided certain conditions are met. These can include things like use of investment (did you actually build the new business school you borrowed money to build?), growth (in terms of finances or student numbers), ESG (are you doing good things as regards environment, society, and governance?) and good standing (are you in trouble with the regulator?) – but at a fundamental level will require a sense that your business is financially viable. If covenant conditions are breached lenders will be keen to help if they hear in advance, but your cost of borrowing (the interest rate charged, bluntly) will rise. And you will find it harder to raise finance in future.

This is an environment where it is already hard to raise finance – and in establishing new borrowing, or new revolving credit (kind of like an overdraft facility) many universities will end up paying more than in previous years. This all needs to be shown in the accounts.

Going concern

When your auditor signs off your accounts, you would very much hope that it will agree that they represent a “going concern” – simply put, that in most plausible scenarios you will have enough money to cover your costs during the next 12 months. If your auditor disagrees that you are a going concern you are in serious trouble – all of the 117 sets of accounts I have read so far have been agreed on a going concern basis.

This designation tells everyone from regulators to lenders to other stakeholders that your business is viable for the next year – and comes into force on the day your accounts are signed off by the university and external auditor. This is nearly always for a specific technical reason – additional information that is needed in order to make the determination. For some late publications, it is possible that the delay is a deliberate plan to make the designation last as far into the following financial years as possible. This year (2024–25) is even more bleak than last year – anything that keeps finance cheaper (or available!) for longer will be helpful.

Breaking even and beyond

So your provider had a surplus last year – that’s good right? It means it took in more money than it spent? Up to a point.

In 2023–24 we got the very welcome news that Universities Superannuation Scheme (USS) has been revalued and contributions reduced for both members and employers. From the annual accounts perspective, this will have lowered staff costs (very often one of the most significant costs, if not the most significant cost, for most) in USS institutions. Conversely, the increase in Teachers Pension Scheme (TPS) contributions will have substantially raised costs in institutions required by law (yes, really!) to offer that scheme to staff.

That’s some of the movement in staff costs. However, for USS, the value of future contributions to the current calculated scheme debt (which is shared among all active employers in the scheme) has also fallen. Indeed, as the scheme is currently in surplus, it shows as income rather than expenditure This is not money that the university actually has available to spend, but the drop shows out in staff costs – though most affected separate this out into a separate line it also shows up in the overall surplus or deficit (to be clear this is the accounting rules, there’s no subterfuge here: if you are interested in why I can only point you to BUFDG’s magisterial “Accounting for Pensions” guidelines).

For this reason, many USS providers show a much healthier balance than accurately reflects a surplus they can actually spend or invest. This gives them the appearance of having performed as a group much better than TPS institutions, where the increase in contributions has made it more expensive to employ staff.

Here I show the level of reported surplus(deficit) after tax, both with and without the USS valuation effect. Removing the impact of valuation puts 35 providers (including big names like Hull, Birmingham, and York) in deficit based on financial statements published so far.

[Full screen]

And here I show underlying changes in staff costs (without the USS valuation effect). This is the raw spend on employing staff, including pay and pensions contributions. A drop could indicate that economies have been sought – employing fewer staff, employing different (cheaper) staff, or changes in terms and conditions. But it also indicates underlying changes in TPS contributions (up) or USS contributions (down) with respect to current employees on those schemes.

[Full screen]

Charts updated 11am 27 January to remove a handful of discrepancies.

Fee income

For most universities the main outgoing is staff costs, and the main source of income is tuition fees. Much has been made of the dwindling spending power of home undergraduate fees because of a failure to uprate with inflation, but this line in the accounts also includes unregulated fees – most notably international fees and postgraduate fees. The full name of the line in the accounts is “tuition fees and educational contracts”, so if your provider does a lot of bespoke work for employers this will also show up here.

Both of these areas of provision have seen significant expansion in many providers over recent years – and the signs are that 2023–24 was another data point aligned with this trend for postgraduate provision. For this reason, the total amount of fee income has risen in a lot of cases, and when we get provider level UCAS data shortly it will make it clear that just how much of this is due to unregulated fees. International fees are another matter, and again we need the UCAS end of cycle data to unpick it, but it appears from visa applications and acceptances that from some countries (China, for example) demand has remained stable, while for others (Nigeria, India) demand has fallen.

Here I show fee income for the past two years, and the difference. This is total fee income, and does not discriminate between types of fees.

[Full screen]

One very important thing to bear in mind is that these are figures for the financial year, and represent fees relating to that year rather than the total amount of fees per student enrolled. For example, if a student started in January (an increasingly common start point for some courses at some institutions) you will only see the proportion of fees that had been paid by 31 July shown in the accounts. If you teach a lot of nursing students who start at non-traditional times of the year this will have a notable impact, as will a failure to recruit as many international students as you had hoped to do in January 2024 (though this will also show up in next year’s accounts).

And it is also worth bearing in mind that income from fees paid with respect to students registered at the provider but studying somewhere else via an academic partnership, or involved in a franchise arrangement (something that has seen a lot of growth in some providers) shows up in this budget line.

Other movements

Quite a number of providers have drawn down investments or made use of unrestricted reserves. This is very much as you would expect, these are very much “rainy day” provisions and even if it is not actually raining now the storm clouds are gathering. Using money like this is a big step though – you can only spend it once, and the decision to spend it needs to link to plans not to need to spend it in the near future. So even if your balance looks healthy, a shift like this speaks eloquently of the kinds of cost-saving measures (up to and including course closures and staff redundancy) that you may currently see happening around you.

Similarly, a provider may choose to sell assets – usually buildings – that it does not have an immediate or future use for. The costs of running and maintaining a building can quickly add up – a decision to sell releases the capital and can also cut running costs. Other providers choose to hang on to buildings (perhaps as assets that can be sold in future) but drastically cut maintenance and running costs for this reason. Again, you can (of course) only sell a building once, and a longer term maintenance pause can make it very expensive to put your estates back into use. I should note that the overall condition of university estates is not great and is declining (as you can read in the AUDE Estates Management Report) , precisely because providers have already started doing stuff like this. If the heating seems to be struggling, if the window doesn’t open, that’s why.

In some cases we have seen decisions to pause capital programmes – not borrowing money and not building buildings as was previously planned. Here, the university makes an on-paper saving equivalent to the cost of finance if it was going to borrow money, or frees up reserves for other uses if it was using its own funds. Capital programmes don’t just include buildings – perhaps investment in software (the kind of big enterprise systems that make it possible to run your university) has been paused, and you are left struggling with outdated or unsuitable finance, admissions, or student record systems.

Where we are talking about pausing building programmes it is important to remember that these exist to facilitate expansion or strategic plans for growth. The “shiny new building” is often perceived as a vice chancellor’s vanity project – in reality that new business school and the recruitment it makes possible may represent the university’s best hope of growing home fee income faster than inflation.

What’s next?

We see financial information substantially after the financial year ends – and for most larger providers this comes alongside the submission of an annual financial return to their regulator. We know for instance that the Office for Students is now looking at ways of getting in year data in areas where it has significant concerns, but financial data (by dint of it being checked carefully and audited) is generally historic in nature.

For this reason what is happening on your campus right now is something that only your finance department has any hope of understanding, and there may be unexpected pressures currently driving strategy that are not shown (or even hinted at) in last years’ accounts. Your colleagues in finance and planning teams are working hard to forecast the end of year result, to calculate the KFIs (Key Financial Indicators) that others rely on, and to plan for the issues that could arise in the 2025 audit. The finance business partners or faculty accountants – or whatever name they have where you work – will be gathering information, exploring and explaining scenarios, and anticipating pressures that may require a change in financial strategy.

The data I have presented here is drawn from published accounts – the data submitted to regulators that eventually ends up on HESA may be modified and resubmitted as understanding and situations change – for this reason come the early summer figures might look very different than what are presented here (I should also add I have transcribed these by hand – for which service you should absolutely buy me a pint) – so although I have done my best I may have made transcription errors which I will gladly and speedily correct.

However scary your university accounts may be, I would caution that the next set (2024–25 financial year) will be even more scary. The point at which the home undergraduate fee increase in England kicks in for those eligible to charge it (2025–26) feels a long way off, and we have the rise in National Insurance Contributions (due April 2025) to contend with before then.

There are a small but significant number of large providers looking at an unplanned deficit for 2024–25, as you might expect they will already be in contact with their regulator and their bank. Stay safe out there.

If you are interested in institutional finances, I must insist that you read the superb BUFDG publication “Understanding University Finance” – it is both the most readable and the most comprehensive explanation of annual university accounts you will find.