Opinions vary about the desirability of the levy on international student fees, and the value of the promised return of targeted maintenance grants.

Rightly so. The announcement and the descriptions of policies within, were political in nature. They were made at a party conference rather than a ministerial statement or consultation document – they were designed to please some, challenge others, and above all to start a debate.

And as such, all these opinions are valuable. The government will listen to representations, seek commentary and challenge, and eventually start to spell out some more of the detail and implementation.

Implementation couldn’t care less about opinions or political expediency. Implementation is a matter of whether something can actually be done, and how.

My number one priority

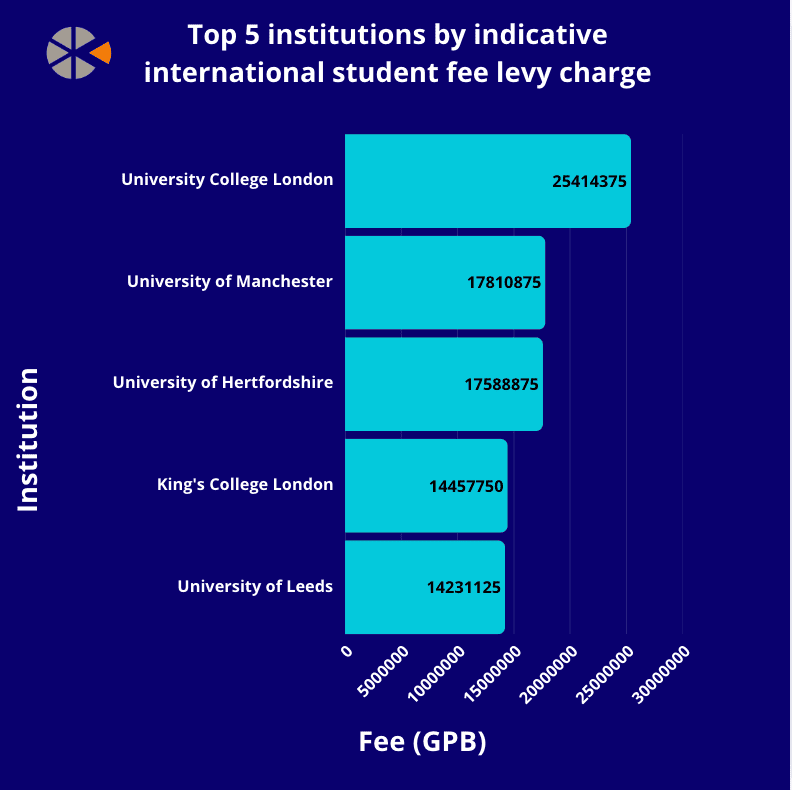

Let’s take the simplistic approach, and call the income the government gets from the levy something around £620m (more on that later).

In the grand scheme of things that’s not a huge amount of money – we paid out more than £8bn on maintenance loans in 2023-24. However, the much-maligned magic money twig (the OfS’ funding for student access and success) is currently just £273m, and it is ostensibly doing part of the same job as the proposed grants – helping non-traditional students access and succeed in higher education. Of course, it mostly goes on hardship grants these days, which is neither what it is designed for nor any meaningful remedy for a student maintenance system that is not fit for purpose. But that makes the parallel even clearer.

Any extra money going to students, in this economy and with this level of unwillingness to do anything truly radical about student hardship, is welcome. But the kicker is that it is not enough to be from a deprived background to get the new money – you also need to be studying the right subjects. As we’ve already noted, these are the same “priority subjects” as have been set within the Lifelong Learning Entitlement: vaguely STEMish, but with no medicine but added architecture and economics.

You survived all you been through

At the end of every cycle UCAS published data on acceptances using a fine-grained (CAH level 3) subject lens, separated by level of deprivation – which in England means the IMD quintile. From this we learn that in the most recent data (2024 cycle) just under 42 per cent of all England domiciled accepted applicants from IMD quintile 1 (the most deprived group) were accepted onto a “priority subject”.

[Full screen]

This is a substantially higher proportion than in any other IMD quintile – it is also a substantially higher number: 39,870. We don’t get quite the same level of subject fidelity for offers and applications, but it appears that quintile 1 applicants are also much more likely to apply to priority subjects than any other group, and slightly more likely to receive an offer.

In other words, as far as we can tell with the available data, there is not really a problem recruiting disadvantaged young people onto courses in subjects that the government is currently keen on.

It is possible ministers may be thinking that adding the grants into the mix would drive these already encouraging numbers up even higher (and away from mere dilettante whims like, er, studying medicine, law, or biology). This would appear to ignore a rather expensive and lengthy experiment that has demonstrated that financial concerns (in the form, back then, of the sticker price) do not actually affect applicant behavior all that much, and when applicant behaviour is already trending in the way you might hope there’s maybe not a lot needs to be done.

But if you assume that the entire annual levy covers a single year of grants for everyone in IMD quintile 1 in a priority subject – and let’s use the exact numbers here – we get 39,870 students sharing £620.52m: £15,560 each.

That is baking in a bunch of assumptions around the way the levy is implemented, the way grant allocations are determined (is IMD, an area based measure, really the best way to allocate individual grants?), and even whether the entire levy is to be spent directly on grants and nothing else. But if these rather optimistic assumptions are right, we’re slightly above the current maximum loan (£13,762), and beginning to approach the government’s National Living Wage for those aged 18 to 20 (currently just under £18k). It’s not quite enough to live as a student for a year without working at all, but it would mean someone without any other means of support might not have to “work every hour god sends.”

I’ll let you be my levy

Let’s say you are an international student looking to study an integrated (4-5 year) Masters’ course in biomedical engineering at the University of Leicester. You’d be charged £25,100 a year (plus £6,275 if you do a year overseas, or £3,765 if you do a year in industry). As you are resident outside of the UK, you’d pay a deposit of £3,000 up front to secure your place. These figures will vary vastly depending on your choice of course and provider, but that gives you an idea of a ballpark figure.

If you secured your place via an agent, you may have paid a fee up front to them. Your chosen university would also pay a fee to the agent for each successful application – these vary hugely, but let’s say it is 20 per cent of your first year of fees. In some cases, your university would also pay a direct fee to the agent, over and above their percentage of fee income. Combined, these can get pretty intense – far into the millions for providers that use agents, with some pushing £30m

If you don’t quite meet some of the academic or English language requirements for your course, you may be accepted onto an international foundation year – often offered by another provider, either on behalf of your university or as a stand alone course. There will be fees for this too.

Of course, before you are accepted onto your course, you’ll need a Tier 4 Student Visa. For all but a handful of countries, you’ll need evidence (the example given by the Foreign Office is a bank statement) that you currently have enough money to cover your fees for your first year plus nine months of living costs. Your visa will cost £524, plus you need to pay a healthcare surcharge (each year) of £776 each year.

Let’s imagine for a moment that you never made a name for yourself

If you are looking to design a levy, the first decision that you make will be what constitutes international fee income. Should it be the sticker price – as promoted to students? Should it, for example, include the fees an institution pays to an international agent? Should it include fees that the student pays to another institution for a co-branded international foundation year? Should you factor in that students are already paying a levy of sorts to cover the cost of issuing a visa or of providing access to the NHS? Should it include accommodation fees (or additional course fees) when these are paid directly to the provider?

Or should a provider pay a proportion of everything it declares as (and auditors agree that is) international student fee income? At what point – when the fee is paid, when the course starts, when it is declared? And is there not a case to look at a levy on agents fees – there is big money to be made by agents, and unlike with providers no counter arguments about the student experience?

The modelling I’ve done so far is deliberately simplistic – 6 per cent (or whatever is decided on) of declared fee income in the most recent HESA Finance Data. That’s a valid answer, but it is limited – it is not the same effect as you would get if a university had to pay 6 per cent of every international student’s fee at one of the points above. The Home Office modelling noted that in some cases fees themselves may rise to cover the levy, which may have a knock on effect on recruitment – and that in other cases providers themselves would swallow the cost.

If you think about it like that – and also bear in mind the Public First angle on the types of students more likely to be dissuaded by higher fees – it is difficult not to see the regressive nature of the levy: well-off providers, who recruit well-heeled middle class students from countries where salaries are high, will pay more but will be able to pass the costs on to students. Providers newer to international recruitment, at the price sensitive end of the market, will lose out either way, and will have to work out whether the recruitment drop of a 6 per cent fee hike is worth more than 6 per cent of their current income.

Such a funny thing for me to try to explain

What if we don’t take the accountant’s way out? What if we calculate a levy based on what individual students actually pay?

As noted above we don’t know – either generally or individually – what international students pay as fees. We also don’t really know how many students are currently paying them – HESA student data turns up after a quite considerable lag, and not all undergraduates (and no postgraduates!) show up in UCAS data.

The closest we get to international student numbers, at all levels, in-year has historically been OfS’ HESES collection (which it uses to allocate OfS grant funding). I say historically because, from 2025-26 the information on domicile (previously used “for planning purposes”) will no longer be collected.

If you want a levy based on what students actually pay, you need a new data collection covering the students involved and how much they have paid that year (perhaps separated out into qualifying and non-qualifying payments – with all of the early iteration problems that such things bring. Data Futures may eventually get there, but not for a good few years yet.

Designing a new data collection is not for the faint of heart – we scrapped an entire section of the Higher Education (Freedom of Speech) Act (the bit dealing with income from overseas) primarily because it is a million times easier to torturously audit other data than to collect something new. It would be expensive, both centrally and for individual providers – and it would be commercially sensitive (not all international students pay the same fee for the same course at the same university).

Know we’re jumping the gun

At every point in this article, I’ve tried to get across just how broad brush the current details of this policy are. As my colleague Michael notes elsewhere, there is not even clarity that these two halves of an announcement are a part of the same policy, or that it is possible to irrevocably link an income stream with an outgoing like this in the public accounts.

It is a political announcement, and as such leaping straight to implementation slightly misses the point – like with the “scrapping” of the “fifty per cent participation target” it might well be that how it lands is more important than how it works.

But as I’ve also tried to show, implementation has no time for political expediency. Real decisions need to be taken, and the current configuration of the sector, of the application cycle, and of the various data collections need to be taken into account. And there’s a need to consider whether the behavioural changes you are trying to make would undermine the funding flows that you are intending will do so – the more parts to a policy the more unintended consequences there could be.