The U.S. Department of Education, under the renewed influence of the Trump Administration and its deep-pocketed friends in the for-profit and debt collection industries, has issued a chilling reminder of just how little it cares for the tens of millions of Americans drowning in student debt. Cloaked in bureaucratic language and peppered with sanctimonious calls for “shared responsibility,” the Department’s latest notice is, in truth, a battle cry in its war to privatize higher education, scapegoat the vulnerable, and enrich corporate cronies at the expense of working families.

Let’s call this what it is: a renewed assault on the student debtor class—the adjunct professors, the first-generation college students, the single mothers, the underemployed graduates who were sold a dream of economic mobility and handed a lifetime of debt servitude.

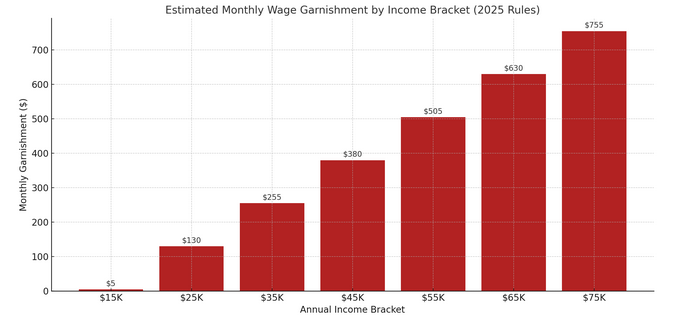

According to the Department, only 38% of borrowers are current on their loans, and nearly a quarter of all loans are in default or severe delinquency. Rather than treating this figure as evidence of systemic failure—ballooning tuition, predatory lending, lack of loan forgiveness—the Department responds by resuming draconian collection measures like the Treasury Offset Program and Administrative Wage Garnishment. This means that the government will begin seizing tax refunds and garnishing wages of those already pushed to the economic brink.

Worse, the Department has the audacity to wrap this cruelty in the rhetoric of “support” and “outreach.” Borrowers are told that they’ll be reminded of their “repayment obligations” as if they have simply forgotten—not that they’ve been buried under compound interest, stagnating wages, and fraudulent institutions that peddled worthless degrees. The supposed “enhancements” to income-driven repayment plans are little more than PR spin, insufficient to address the tidal wave of suffering inflicted by a broken system.

Then comes the most insulting part: the Department deflects blame onto institutions while simultaneously pressuring them to track down and guilt-trip former students. Colleges are urged to contact former enrollees and remind them they’re obligated to pay. Why? Not out of concern for their welfare—but because high cohort default rates (CDRs) might threaten those institutions’ eligibility for federal aid money.

So we see the real game here: this isn’t about protecting students. It’s about protecting the federal loan program as a revenue engine and shielding the reputations of colleges—especially the for-profit diploma mills that flourished under prior Republican administrations. These institutions can continue hiking tuition and churning out underprepared graduates because the government, under Trump and his Department of Education appointees, would rather collect on unpayable loans than hold schools accountable.

Even more dystopian is the Department’s plan to publicly release “loan non-payment rates by institution.” While transparency sounds virtuous, this move will undoubtedly be weaponized—not to shut down abusive schools but to further stigmatize borrowers, especially those from marginalized backgrounds who attended underfunded schools with few resources.

Nowhere in this document is there any meaningful discussion of debt relief, student protections, or reining in college costs. Nowhere is there a reckoning with the fact that federal student aid has been transformed from a tool of opportunity into a tool of coercion. Instead, the Trump Administration signals it is open for business—the business of extracting wealth from the poor and funneling it into the private sector.

This notice is more than a policy update. It is a declaration of values. And those values are clear: Profit over people. Compliance over compassion. Privatization over public good.

The Higher Education Inquirer stands with the debtors. We see through the lies of “fiscal responsibility” and “integrity.” And we will continue to expose every cynical maneuver designed to crush the educated underclass in the name of neoliberal orthodoxy.

To student borrowers: You are not alone. You are not a failure. You are a victim of a system that was never built to serve you.

Here’s the actual post from the US Department of Education, Federal Student Aid, dated May 5, 2025:

The

United States faces critical challenges related to the federal student

loan programs. According to estimates from the U.S. Department of

Education (Department), only 38% of Direct Loan and Department-held

Federal Family Education Loan Program borrowers are in repayment and

current on their student loans. We also estimate that almost 25% of the

entire portfolio is either in default or a late stage of delinquency.

Given these challenges, the Department is taking immediate steps to

engage student borrowers and support the repayment of their federal

student loans. As announced in an April 21, 2025, press release,

today, the Department will resume collections on its defaulted federal

student loan portfolio with the restart the Treasury Offset Program and,

later this summer, Administrative Wage Garnishment. The Department has

also initiated an outreach campaign to remind all borrowers of their

repayment obligations and provide resources and support to assist them

in selecting the best repayment plan for their circumstances. The

Department has also launched an enhanced income-driven repayment (IDR) plan process,

simplifying how borrowers enroll in IDR plans and eliminating the need

for many borrowers to manually recertify their income each year.

Maintaining the integrity of the Title IV, Higher Education Act of 1965 (HEA)

loan programs has always been a shared responsibility among student

borrowers, the Department, and participating institutions. Although

borrowers have the primary responsibility for repaying their student

loans, institutions play a key role in the Department’s ongoing efforts

to improve loan repayment outcomes, especially as the cost of college

set solely by institutions has continued to skyrocket. Institutions are

responsible for providing clear and accurate information about repayment

to borrowers through entrance and exit counseling, and colleges and

universities are responsible for disclosing annual tuition and fees and

the net price to students and their families on the costs of a

postsecondary education. The financial aid community has demonstrated

its commitment to providing direct advice and counsel to students

regarding their borrowing, but institutions must refocus and expand

these efforts as pandemic flexibilities come to an end.

Under section 435 of the HEA, institutions are required to

keep their cohort default rates (CDR) low and will lose eligibility for

federal student assistance, including Pell Grants and federal student

loans, if their CDR exceeds 40% for a single year or 30% for three

consecutive years. The Department reminds institutions that the

repayment pause on student loans ended in October 2023, and CDRs

published in 2026 will include borrowers who entered repayment in 2023

and defaulted in 2023, 2024, or 2025. The Department further reminds

institutions that those borrowers whose delinquency or default status

was reset in September 2024 could enter technical default status / be

delinquent on their loans for more than 270 days beginning in June and

default this summer. As such, we strongly urge all institutions to begin

proactive and sustained outreach to former students who are delinquent

or in default on their loans to ensure that such institutions will not

face high CDRs next year and lose access to federal student aid.

Given

the urgent need to ensure that more student borrowers enter repayment

and stay current on their loans, the Secretary urges each participating

institution to provide the following information to all borrowers who

ceased to be enrolled at the institution since January 1, 2020, and for

whom they have contact information:

-

Remind

the borrower that he or she is obligated to repay any federal student

loans that have not been repaid and are not in deferment or forbearance; -

Suggest that the borrower review information on StudentAid.gov about repayment options; and

-

Request that the borrower log into StudentAid.gov

using their StudentAid.gov username and password to update their

profile with current contact information and ensure that their loans are

in good standing.

The

Department urges that this outreach be performed no later than June 30,

2025. We do not stipulate how institutions reach out to borrowers, nor

the specific information provided, as long as it covers the three

categories described above.

We also encourage institutions to focus their initial outreach on

students who are delinquent on one or more of their loans in order to

prevent defaults. We will provide additional information in the future

to assist schools with identifying and communicating with these

borrowers.

The

Department is committed to overseeing the federal student loan programs

with fairness and integrity for students, institutions, and taxpayers.

To that end, the Department believes that greater transparency is needed

regarding institutional success in counseling borrowers and helping

them get into good standing on their loans.

The Department maintains data on the repayment status of federal

student loan borrowers and in the past has provided information in the

College Scorecard about the status of each institution’s borrowers at

several intervals after they enter repayment. The Department plans to

use this data to calculate rates of nonpayment by institution and will

publish this information on the Federal Student Aid Data Center later

this month. The Department will provide more information about this

publication process soon.

Thank you for your continued efforts to maintain the integrity of the Title IV, HEA

loan programs. The Department values its institutional partners and

looks forward to continued collaboration to place borrowers on the path

to sustainable repayment of their loans.