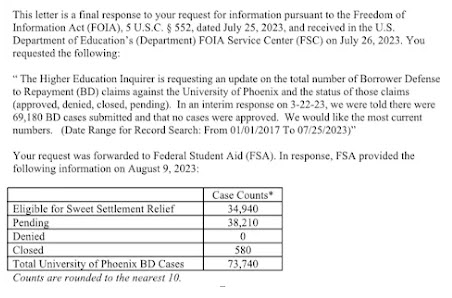

The pivot toward blaming the Department of Education does not merely look defensive; it echoes a pattern that helped bring down an entire generation of predatory schools. And it raises a simple question: why is PXED responding like institutions that have something to hide?

The University of Phoenix, under PXED’s ownership, carries not just a long memory of investigations and settlements but a structural DNA shaped by years of aggressive enrollment management, marketing overreach, and high-pressure tactics. When the industry was confronted with evidence of systemic abuses—lying about job placement, enrolling ineligible students, manipulating financial-aid rules—the typical industry defense was to claim that problems were caused by bad actors, by misinterpreted regulations, or by a sluggish and incompetent Department of Education.

Those excuses were not convincing then, and they ring even more hollow now.

If individuals involved in financial-aid fraud managed to slip into the system, an institution with PXED’s history should be the first to strengthen internal controls, not pass the buck. Schools are required under federal law to verify eligibility, prevent fraud, and monitor suspicious patterns. Pretending that ED is solely responsible ignores the compliance structure PXED is obligated—by statute—to maintain.

Instead of demonstrating transparency or releasing information about internal controls that failed, PXED’s leadership has opted for a public relations gambit: blame the regulator. This raises several concerns.

First, shifting responsibility before releasing evidence suggests that PXED may be more focused on reputational management than on institutional accountability. If the organization’s processes were sound, those facts would speak louder—and more credibly—than an accusatory press statement.

Second, the posture is déjà vu for people who have tracked the sector for decades. Corinthian Colleges, ITT Tech, Education Management Corp., and Career Education Corporation all blamed ED at various stages of their collapses. In each case, deflection became part of the pattern that preceded deeper revelations of systemic abuse.

When PXED’s CEO adopts similar rhetoric, observers reasonably wonder whether history is repeating itself—again.

Finally, PXED’s argument undermines trust at a moment when the University of Phoenix is already under skepticism from accreditors, policymakers, student-borrower advocates, and the public. Instead of strengthening compliance, PXED’s messaging signals defensiveness. Institutions with nothing to hide usually take a different approach.

PXED acquired the University of Phoenix with promises of modernization, stabilization, and responsible stewardship. But beneath the marketing, core challenges remain:

A business model dependent on federal aid. The more a school relies on federal dollars, the stronger its responsibility to prevent fraud—not the weaker.

A compliance culture shaped by profit pressure. For-profit education has repeatedly shown how financial incentives can distort admissions and oversight.

A credibility deficit. PXED took over an institution known internationally for deceptive advertising and financial-aid abuses. Blaming ED only magnifies the perception that nothing has fundamentally changed.

A fragile regulatory environment. With oversight tightening and student-protection rules returning, PXED cannot afford to gesture toward the old for-profit playbook. Doing so suggests they are trying to manage optics instead of outcomes.

If PXED wanted to demonstrate leadership rather than defensiveness, a different response was available:

• Conduct and publish a full internal review of financial-aid intake processes

• Outline steps to prevent enrollment of fraudulent actors

• Acknowledge institutional lapses—and explain how they occurred

• Invite independent audits rather than blaming federal partners

• Demonstrate an understanding of fiduciary obligations to students and taxpayers

This is the standard expected of Title IV institutions. It is also the standard PXED insists they meet.

Every moment of pressure reveals something about institutional culture. PXED’s choice to immediately fault the Department of Education—without presenting evidence of its own vigilance—suggests that the company may still be operating according to the old Phoenix playbook: when in doubt, blame someone else.

But in 2025, the public, regulators, and students have seen this movie before. And they know how it ends.

Sources

U.S. Department of Education, Federal Student Aid Handbook

Senate HELP Committee, For-Profit Higher Education: The Failure to Safeguard the Federal Investment and Ensure Student Success

Federal Trade Commission, University of Phoenix Settlement Documents

U.S. Department of Education, Program Review and Compliance Requirements

Higher Education Inquirer archives