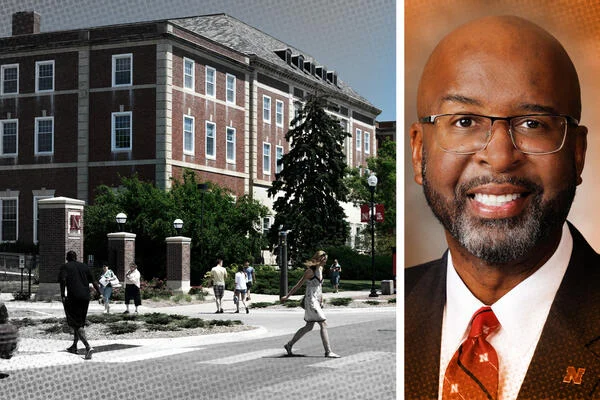

Weeks after pushing through deeply unpopular program cuts, University of Nebraska–Lincoln chancellor Rodney Bennett has left his role six months early—with a $1 million golden parachute.

His exit at Nebraska has prompted faculty concerns about executive spending as questions linger about whether program cuts driven by Bennett were avoidable. NU system officials, however, have defended the cuts as necessary due to a recurring budget deficit and argued that Bennett’s exit package is what was owed to him—a mix of unpaid leave, deferred income, health-care benefits and the remainder of his contract set to expire in June.

For Bennett, this marks the second time since 2022 that he has left a job early, departing his role as president of the University of Southern Mississippi a year ahead of schedule after nearly a decade at the helm there.

(A UNL spokesperson said Bennett was not available for an interview with Inside Higher Ed.)

Now UNL will soon embark on a new chancellor search as tensions simmer over recent events, though NU system President Jeffrey Gold noted a “need for healing” before that process begins.

Contentious Cuts

Bennett’s budget-reduction plan was unveiled to much faculty dismay in November.

While he initially proposed cutting six programs, that was later whittled down to four: statistics, earth and atmospheric sciences, educational administration, and textiles, merchandising and fashion design. Four more programs will be “realigned” into two new schools, under the plan.

The program eliminations will cut 51 jobs at UNL, most from the faculty ranks.

Other actions taken include faculty buyouts, which are expected to save $5.5 million; budget reductions at four of UNL’s colleges; and the elimination of some administrative and staff roles.

Those cuts, already unpopular, sting more now after Bennett officially stepped down Monday with an exit package of $1.1 million—prompting faculty outrage over spending priorities.

“The university cannot credibly claim that it lacks the resources to sustain academic programs and faculty positions while simultaneously paying over a million dollars to a failed chancellor,” Sarah Zuckerman, president of the UNL chapter of the American Association of University Professors, said in a statement sent to Inside Higher Ed and other media outlets. “This payout exposes the administration’s financial crisis narrative as a matter of priorities, not necessity.”

But Gold, NU system president since July 2024, notes the exit package will not be funded by taxpayer dollars and said the decision to leave early was “mutually discussed” with Bennett, his family and senior leadership and was made with the “best interests” of the campus in mind.

“The separation agreement—all components of it—will not be funded either from state appropriations or tuition funds, but rather entirely through other university discretionary resources, meaning privately raised dollars,” Gold told Inside Higher Ed. “It’s always a balance, but an attempt was made, and I think in this instance, successfully, to not use the same dollars that are used to support our faculty and our staff and, most importantly, our students.”

Many faculty members are also seething about what they see as fuzzy math to justify the cuts.

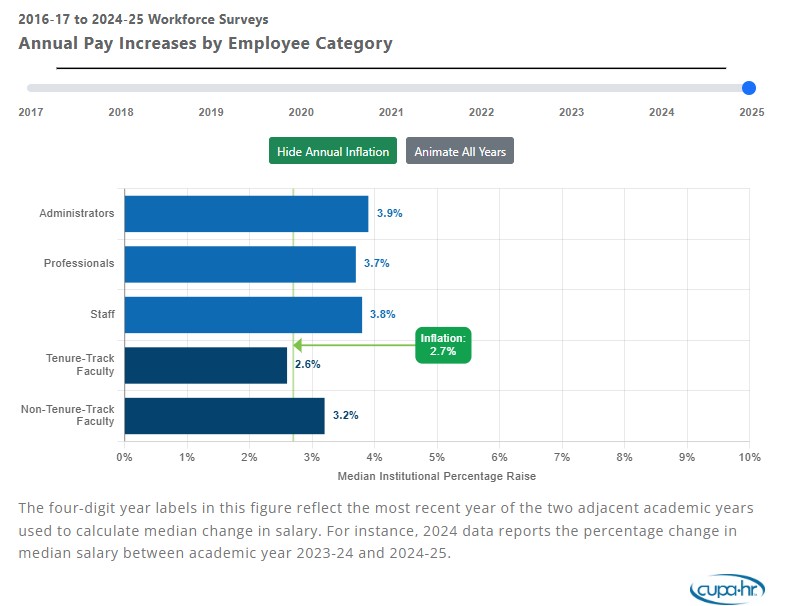

An outside analysis, conducted by the AAUP, argued that instructional spending across the system has declined in recent years while administrative pay rises and that the cuts fell disproportionately on the academic side. The analysis also suggested that by increasing its endowment draw by 1.3 percent, bringing it up to 6 percent, UNL would have been able to avoid cuts.

Gold said that “perhaps the campus has seen that analysis,” but he has not. He largely dismissed the notion of increasing the endowment draw, noting such a move is “at the discretion of the Board of Directors and senior leadership of the [University of Nebraska] Foundation.” Gold also underscored that two of the four program closures were supported by the Academic Planning Committee, a group of faculty, staff, students and administrators—though that fact has done little to assuage the concerns of others who have protested the cuts as needless or flawed.

Faculty Tensions

Faculty have also accused Bennett of steamrolling them in the process to determine the cuts. In November, UNL’s Faculty Senate voted no confidence in Bennett and urged Gold to evaluate Bennett’s “continued fitness to serve” as chancellor.

The no-confidence resolution blasted Bennett for “failures in strategic leadership, fiscal stewardship, governance integrity, external relations, and personnel management.” Those concerns are among many complaints from faculty during Bennett’s tenure.

Regina Werum, a UNL sociology professor and member of UNL’s AAUP chapter, told Inside Higher Ed by email that Bennett had “no rapport with faculty” and was rarely seen on campus.

“The Chancellor’s style is best described as disengaged from and more accurately as disdainful of faculty, staff, and students. He keeps himself insulated and largely invisible on campus, making sure to be present for photo ops with superiors and dignitaries,” Werum wrote.

A former Southern Miss official who worked with Bennett at that campus offered a similar take. Speaking anonymously, the former official said Bennett was a rare sight on campus and tended to offer scripted remarks to faculty. That official also criticized Bennett’s inexperience with teaching and research, noting he stepped into the job with a student affairs background.

“The problem was he didn’t want you to know that he didn’t know things, and because of that, he wouldn’t ask questions,” the anonymous official said. “It was a conundrum. You would try to help him understand what was going on, but he didn’t want to admit that he didn’t understand it all.”

Bennett also enacted program cuts at Southern Miss, axing dozens of positions.

The former official said Bennett’s cabinet encouraged him to consider other options at Southern Miss, but he wasn’t interested in having those conversations and saw cuts as the only route to plug budget holes. The anonymous administrator also said Bennett often ignored faculty advice.

“When he reorganized the Gulf Coast campus, he put together two large committees, 30 people each, that worked for six months coming up with recommendations,” they said. “And then when he rolled out the plan for the Gulf Coast, there was a lot of stuff in there that none of the committees had ever discussed. People felt like they wasted a lot of time on these committees, and they were designed to give him cover for the changes he was going to make anyway.”

The former USM official believes it was an enrollment collapse at that campus, known as Southern Miss Gulf Park, that hastened Bennett’s exit from a job he had held since 2013. Bennett initially announced in January 2021 that he planned to step down when his contract ended in June 2023. However, Bennett was officially out by June 2022, with no explanation.

Months later, a member of the Institutions of Higher Learning Board of Trustees, which oversees Southern Miss and other universities, told local media he was “embarrassed” by the enrollment collapse at the satellite campus, which plunged by more than 50 percent from 2011 to 2022.

Despite sharp faculty criticism, Gold praised Bennett for his time as chancellor.

“For the 18 months that I had the privilege of working with Chancellor Bennett, I really enjoyed working with him. I found him to be very thoughtful, easy to work with, a very solid human being with a very strong love of higher education, and particularly public higher education,” Gold said.

But if Gold felt differently, he wouldn’t be able to say so.

A nondisparagement agreement in Bennett’s separation agreement prevents certain university and system officials, including Gold and members of the Board of Regents, from making “any negative or disparaging comments or statements” about the now-former Nebraska chancellor.