Dive Brief:

- The U.S. Department of Education on Thursday released final regulations that will bar organizations the agency deems as having a “substantial illegal purpose” from being a qualifying employer for the Public Service Loan Forgiveness program.

- The Trump administration’s new rule will exclude organizations from the PSLF program that it determines to be “supporting terrorism and aiding and abetting illegal immigration,” among other activities, according to Thursday’s announcement.

- Several advocacy groups immediately vowed to challenge the rule in court. They and other opponents argue the agency is politicizing the PSLF program and will use the new rule to remove organizations with goals not aligned with the Trump administration, such as providing gender-affirming care or supporting undocumented immigrants.

Dive Insight:

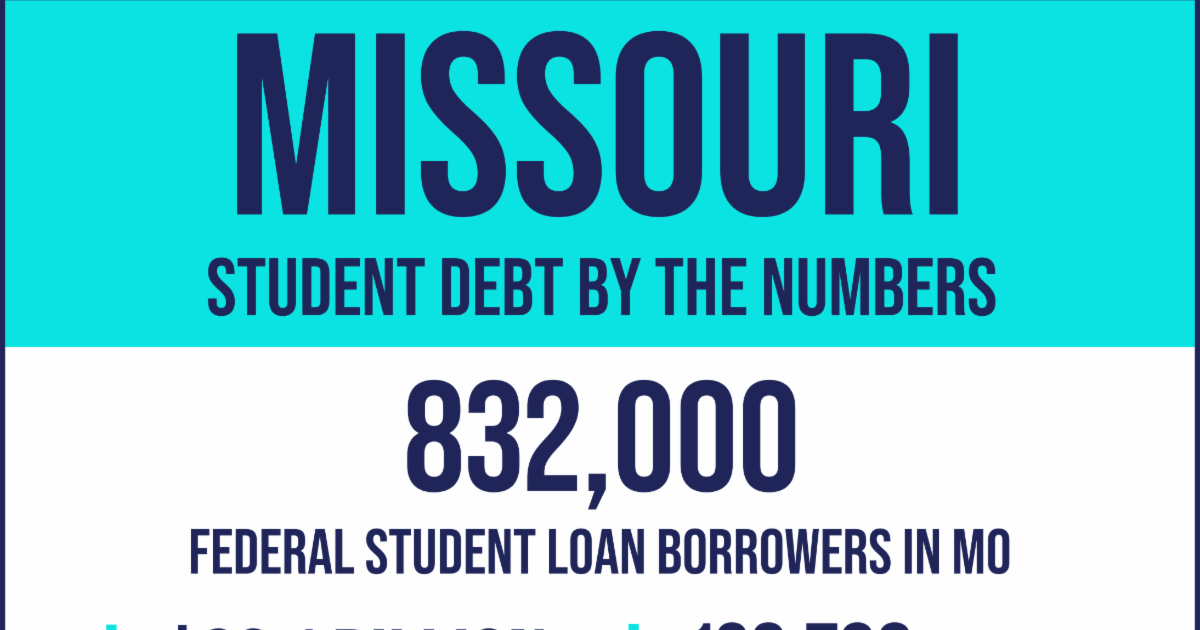

Congress created the PSLF program in 2007 to allow college graduates who work for government employers, including school districts, and certain nonprofits to receive debt relief on their student loans after making a decade of qualifying payments.

Many borrowers initially struggled to get relief through the program due to confusing eligibility requirements and loan servicer issues. As of April 2018, for example, just 55 workers had received debt relief through PSLF, according to a report that year from the U.S. Government Accountability Office.

To address the problems, the Biden administration eased some of the program’s requirements in October 2022 for one year. The administration also released regulations that expanded which loan payments counted toward PSLF beginning in 2023.

By October 2024, over 1 million workers had received relief through the program during the Biden administration, the White House said at the time.

But in a March executive order directing the Education Department to change PSLF’s eligibility requirements, President Donald Trump accused the prior administration of abusing the program by relaxing its requirements. Trump also contended that the program sent tax dollars to “activist organizations” that harm national security and undermine American values.

The Education Department’s final rule, which takes effect July 2026, is meant to carry out the executive order. It will bar organizations from the PSLF program if the Education Department determines they illegally:

- Aided and abetted violations of federal immigration law.

- Aided and abetted illegal discrimination.

- Supported terrorism or engaged in violence “for the purpose of obstructing or influencing Federal Government policy.”

- Engaged in “chemical and surgical castration or mutilation of children” — a common conservative description of providing gender-affirming care for transgender minors.

- Engage in the “trafficking of children” across state lines to emancipate them from their parents.

- Have a pattern of violating state laws.

The U.S. education secretary will determine whether employers have a “substantial illegal purpose” based on “a preponderance of the evidence,” which can include final federal or state court rulings or settlements in which organizations admit they engaged in illegal activities, according to an agency fact sheet.

Employers who are notified of such a finding will have an opportunity to respond and appeal.

They will also be able to “enter into a corrective action plan” with the Education Department to avoid being blocked from the program, according to an agency fact sheet. However, if they lose access to PSLF, they will only be able to reapply after 10 years.

If an organization is blocked from the program, loan payments made by its employees will still count toward their PSLF’s 10-year clock until the Education Department’s finding takes effect, according to a fact sheet.

“However, any payment made after an employer is deemed no longer eligible for PSLF will not be counted toward the number of payments to forgiveness,” the department said in the 185-page final rule, set to be published on Friday. “This approach ensures that workers who have served in good faith are not punished, while also protecting taxpayers by preventing benefits from flowing to unlawful conduct in the future.”

Student advocacy and nonprofit groups have decried the new rule.

Aaron Ament, president of the National Student Legal Defense Network, vowed in a Thursday statement to sue in the next few days.

“Instead of supporting first responders, healthcare workers, and teachers working to make our country a better place, the Trump Administration is punishing public servants for their employers’ perceived political views,” Ament said.

Democracy Forward and Protect Borrowers, two other advocacy groups, likewise said they would challenge the rule in court. In a joint statement Thursday, they said the rule would allow the Education Department to target organizations that support immigrants, provide gender-affirming care and protect the free speech rights of protesters.

“This new rule is a craven attempt to usurp the legislature’s authority in an unconstitutional power grab aimed at punishing people with political views different than the Administration’s,” they said.