AFT President Randi Weingarten has been a loud advocate for protecting borrowers’ rights to loan repayment programs.

Chip Somodevilla/Getty Images

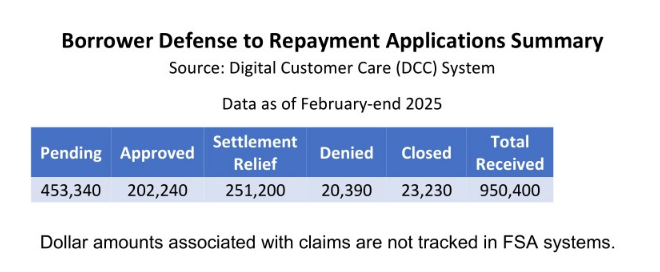

The Department of Education has accumulated a backlog of more than 800,000 applications for income-driven loan repayments (IDR) as of Dec. 15, according to the most recent status report in a lawsuit filed by the American Federation of Teachers (AFT).

The union originally sued the department in March for pausing all applications to IDR plans, loan consolidation and the Public Service Loan Forgiveness program, but the case was quickly settled as the department reopened the application portal and committed to providing regular status updates.

For five months, the status reports carried on and the case remained quiet. But then, in September, AFT filed an amended class action complaint and motion for preliminary injunction, arguing that just because the portal is open doesn’t mean it is working properly. Tens of thousands of applications were going untouched, violating the rights of the borrowers who submitted them.

In October, the department again reached a settlement with the plaintiffs, committing to process applications, and the motion was stayed. But now, with the latest status report released, AFT argues that the department isn’t holding up its end of the deal.

“The problem is they don’t appear to have kept their word,” Randi Weingarten said in a news release Wednesday. “The borrower backlog remains eye-popping, and Education Secretary Linda McMahon clearly has no idea how to manage this process.”

In addition to the backlog of pending loan repayment applications, the report shows that only 170 borrowers at the end of their IDR plan and 280 borrowers who have completed their PSLF payments have received their rightful loan forgiveness.

Weingarten suggested that in addition to loan forgiveness being low on the Trump administration’s list of political priorities, much of the backlog is due to major staffing cuts.

“Perhaps [Secretary McMahon] shouldn’t have sold the Department of Education off for parts,” the union president said. “President Donald Trump and Vice President JD Vance may believe affordability is a hoax, but hundreds of thousands of Americans just trying to get ahead are bleeding—and the administration’s lack of action is rubbing salt into the wound.”

So, until the department “follows the law and processes every single outstanding application,” she added, AFT will not stop fighting its case.