The Pay Teachers Act, co-sponsored by eight Democratic senators including Elizabeth Warren and Ed Markey, would establish the first federal mandate for teacher salaries and represents the most ambitious federal intervention in educator compensation in decades.

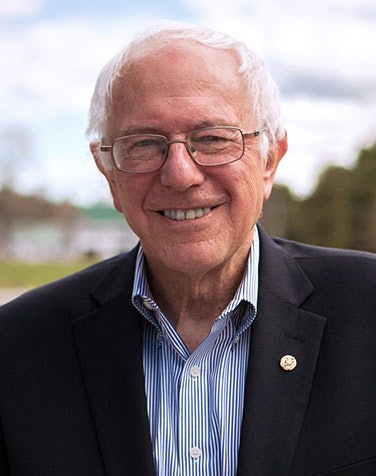

“Just four hedge fund managers on Wall Street make more money in a single year than every kindergarten teacher in America combined—over 120,000 teachers,” Sanders said. “No public school teacher in America should make less than $60,000 a year.”

The legislation comes as schools nationwide face unprecedented staffing shortages, with nearly 200,000 teaching positions either vacant or filled by underqualified educators. According to the bill’s findings, 38% of teachers nationwide earn less than $60,000 annually, with starting teachers averaging $44,530.

Maria Gonzalez, a third-grade teacher from Arizona who testified at the town hall, said she drives for Uber on weekends and tutors after school to pay rent.

“My students ask why I look tired. How do I tell them their teacher can’t afford to live in the community where she teaches?”

The crisis extends beyond low pay. Twenty-one percent of elementary and middle school teachers’ families rely on public assistance programs including Medicaid, food stamps, and the Earned Income Tax Credit, according to a University of California, Berkeley study cited in the legislation. Additionally, 44% of public school teachers quit within five years, and 17% worked multiple jobs during the 2020-2021 school year.

The comprehensive bill would cost approximately $400 billion over five years, funded through mandatory appropriations. Beyond the $60,000 minimum salary requirement, the legislation would triple Title I funding, provide teachers with at least $1,000 annually for classroom supplies, and mandate that paraprofessionals and education support staff earn at least $45,000 annually or $30 per hour.

States would have four years to implement the salary requirements, with extended timelines available for states demonstrating substantial financial need. The bill also includes $50 billion annually for career ladder programs allowing teachers to advance without leaving the classroom.

The teacher shortage disproportionately affects schools serving students of color and low-income communities, which are four times more likely to employ uncertified teachers than schools with low minority enrollment, according to federal civil rights data cited in the legislation.

James Williams, a high school mathematics teacher from North Carolina, told the town hall that his salary purchased “a decent life” 15 years ago but now forces him to choose between car repairs and classroom supplies.

The legislation faces significant political obstacles with Republicans controlling the House. GOP lawmakers have criticized the massive federal spending, while some education policy experts question federal involvement in traditionally state and local compensation decisions.

Major education unions endorsed the proposal. American Federation of Teachers President Randi Weingarten called it “a crucial federal investment to help sustain the teaching profession,” while National Education Association Vice President Princess Moss praised it as legislation that “invests in our students, educators, and public schools.”

Sanders criticized recent Republican legislation that he said provides “$900 billion in tax cuts to large, profitable corporations and a $1 trillion tax cut to the top 1%” while cutting over $300 billion in education funding. The Trump administration is also withholding nearly $5.5 billion in congressionally appropriated education funding, according to Sanders and his colleagues.

“If we can provide over a trillion dollars in tax breaks to the top 1% and large corporations, please don’t tell me that we cannot afford to make sure that every teacher in America is paid at least $60,000 a year,” Sanders said.