(To support my writing, I may use affiliate links in the post. Rest assured, they don’t affect my honest reviews.)

Looking for Udacity discounts or coupon codes? You’re in luck!

Udacity is currently offering a massive 55% off (coupon code: FUTURE40) on all course access, bundles, and standalone Nanodegree programs.

This is the highest discount Udacity is offering right now on its subscription plans, valid in most countries until January 6, 2026.

If you’re planning to enroll in a Nanodegree program – to learn in-demand tech skills, get expert mentorship, and boost your career – this is the perfect time to save big. Don’t miss out on these huge savings.

Not sure if this Udacity discount is worth it or how it can benefit your career? Keep reading – I’ll break it all down for you.

But first, let’s see how much Udacity and its Nanodegree programs will cost you after this discount.

💰 Udacity Regular Cost vs. 55% Off Discounted Cost”

In the US (USD)

- Monthly Subscription

- Regular Price: $249/month

- Discounted Price: $113/month

- Individual Course Bundle (with 15% off based on avg. completion time)

- Regular Price: Starts at $249/month

- Discounted Price: Starts at $113/month

In India (INR)

- Monthly Subscription

- Bundle Course / Individual Nanodegree (with 15% off based on avg. completion time)

- Regular Price: ₹17,911/month

- Discounted Price: ₹8,050/month

Note: I’ve listed the monthly subscription discounts here; however, the 55% discount also applies to bundle subscriptions for longer durations.

Review – Is Udacity 55% Off (January Sale) Worth Grabbing?

If you’re wondering whether this discount is really worth the investment, my answer is yes.

Udacity subscriptions and programs aren’t cheap, but this 55% discount on all Udacity pricing plans makes them much more affordable.

And it’s not just about saving money – this heavy discount unlocks all Nanodegree programs, giving you the freedom to learn whatever you want. It’s a great opportunity if you want to:

- Enroll in multiple programs at once, from beginner to advanced levels, without worrying about the cost of each individual program.

- Easily switch between Nanodegree programs if one doesn’t meet your learning goals.

- Explore new career paths—from programming to data analytics, AI to cybersecurity, Udacity offers a wide range of Nanodegree programs in every major tech domain.

If you’re concerned about whether Udacity programs provide the right training or help you land a job, let me explain why they’re worth it – especially with the current 55% off sale.

Why Choose Udacity?

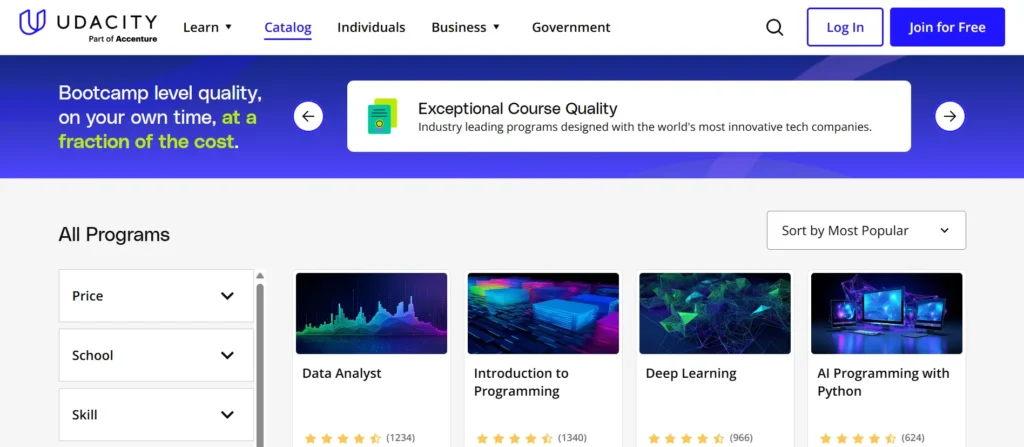

Udacity is a top-notch online learning platform offering high-quality courses and training programs, mostly in in-demand tech fields.

These Nanodegree programs are not accredited by any educational institution, but they are developed in collaboration with leading tech companies in their respective industries, and their value comes from these companies themselves.

For example, the Udacity Digital Marketing Nanodegree is built in collaboration with Google, Meta, and other top tech firms.

Now, there’s no guarantee that holding a Nanodegree will land you a job at these top companies, as it depends on many factors – your hard skills, soft skills, academic background, and overall work experience. However, I can confidently say that the quality of training you’ll receive is truly worth it.

Most Udacity Nanodegree programs are taught by industry experts who already work in the field you aspire to enter.

From real-world projects to hands-on learning and career mentorship, these Nanodegree programs delivers exceptional value.

If you want to test the quality yourself, start with these free programs I’ve personally taken:

- AWS Machine Learning Foundations

- Intro to Python Programming

- Intro to Data Structures and Algorithms

- Developing Android Apps with Kotlin

You won’t need to pay anything – just sign up and start learning. These courses are beginner-friendly, so anyone can enroll. Once you’re satisfied with the quality, you can grab the subscription at 55% off.

⚠️ Note: This discount is only valid until January 6, 2026—so don’t wait too long! If finding worth it, claim your 55% Udacity discount.

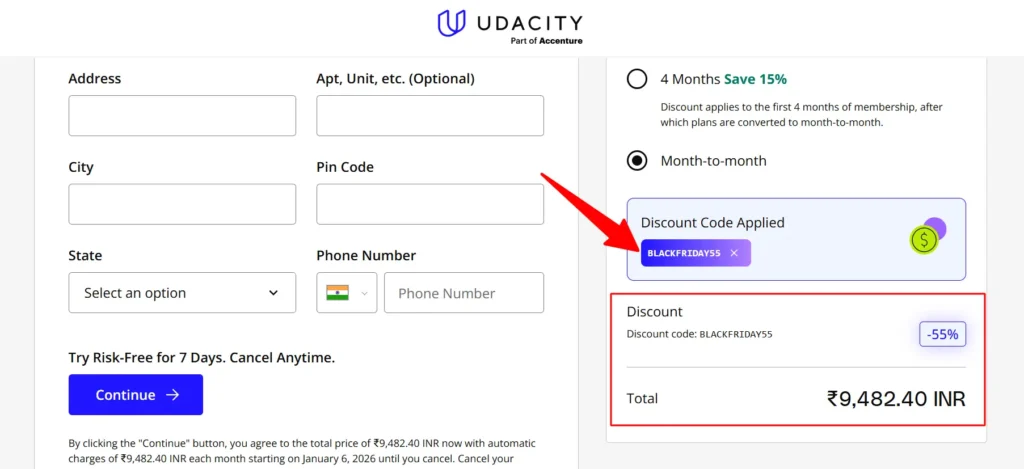

How to Get Your 55% Off Udacity Discount: Step-by-Step Guide

Follow these steps to get Udacity’s biggest discount on its subscription:

- Visit Udacity.com

- Find the Nanodegree program you want to enroll in, or select any Nanodegree if you plan to purchase the Udacity subscription.

- Scroll down – on the right-hand side, you’ll see the regular pricing plans with the 55% off offer displayed below.

- Click the discount button, sign up for a free account, and log in.

- Choose your pricing plan- either month-to-month or a bundled course plan (longer duration). Both options include the 55% discount.

- Apply coupon code FUTURE40 and review the final cost.

- Complete your purchase by entering your payment details and confirming the payment.

Act fast – this offer expires is only available for a week, valid until January 6, 2026.

Top Udacity Nanodegree Programs – Access with Udacity 55% Off:

Udacity is best known for its Nanodegree programs. With the current 55% off offer, you can access some of the most popular ones.

These programs are featured based on:

- Verified learner feedback from communities like Reddit, Quora, and Trustpilot

- Enrollment volume and course completion rates (where available)

Popular Udacity Nanodegree Programs You Can Get with 55% Off

- Introduction to Programming – Build a strong foundation in web development and Python programming over four months. This beginner-friendly program includes hands-on projects, making it perfect for newcomers to coding.

- Business Analytics Nanodegree – Learn SQL, Python, data visualization, and advanced Excel in just two months—no prerequisites required. Ideal for aspiring business, data, or financial analysts.

- Data Analyst Nanodegree – Gain skills in data cleaning, exploratory analysis, and regression testing. Requires prior knowledge of Python, SQL, and statistics. Perfect for finding patterns in complex datasets.

- Data Engineering with AWS -Learn to build scalable data infrastructure using AWS tools like S3, Redshift, and Lambda. Covers data modeling, warehousing, and big data technologies. Best for those with programming experience transitioning to data engineering.

- Digital Marketing Nanodegree – Covers SEO, SEM, social media marketing, email marketing, and online advertising. Beginner-friendly and ideal for launching a digital marketing career.

- Deep Learning Nanodegree – Master neural networks, NLP, computer vision, and reinforcement learning through hands-on AI and machine learning projects.

- Programming for Data Science with Python – Start from scratch and learn Python, data visualization, and machine learning using NumPy, Pandas, and Scikit-learn. Includes real-world projects for practical skills.

- Front-End Web Developer – Learn HTML, CSS, JavaScript, and React to create responsive, interactive websites. Includes hands-on projects for beginner web developers.

- Data Scientist Nanodegree – An advanced program covering machine learning, data wrangling, and predictive modeling. Requires Python, SQL, and data analysis experience.

- C++ Nanodegree – Master object-oriented programming, memory management, and multithreading in C++. Great for software, game, and systems development, with mentorship and practical projects.

Note: All these Nanodegree programs are available at 55% off until January 6, 2025.

Final Thoughts: Is Udacity’s 55% Off Sale Worth It?

If you’ve been waiting for the right time to invest in your skills, this is it. Udacity’s 55% off deal is their biggest discount of the year, and it makes their premium Nanodegree programs far more affordable.

Whether you want to start from scratch, switch careers, or upgrade your current skills, this offer gives you access to all Udacity Nanodegree programs—so you can learn at your own pace, explore multiple career paths, and gain hands-on experience through real-world projects.

Remember, Udacity’s programs are built in collaboration with leading tech companies like Google, Meta, and AWS, and taught by industry experts who know what it takes to succeed in the field.

While no certification can guarantee you a job, the skills, mentorship, and project experience you’ll gain from Udacity can put you miles ahead in your career journey.

⚠️ Don’t wait too long—this 55% off offer ends on January 6, 2026. If you’re serious about boosting your career, now’s the time to grab it.

Happy Learning 🙂

Udacity 55% Off – FAQs

How long does the 55% off sale last?

Udacity’s End of Year Sale 55% off sale is valid until January 6, 2026 in most countries. After this date, the offer will expire, and regular pricing will apply. If you’re planning to enroll, it’s best to grab the discount before the deadline.

Udacity 55% Off – Month-to-Month vs. Bundle Subscription: Which One Should You Choose?

When using Udacity’s 55% off deal, you have two options: month-to-month or bundle subscription.

Bundle Subscription – Best for longer-term learning (typically 5–6 months). You lock in the 55% discount for the entire duration of your plan, giving you more time to complete your Nanodegree at your own pace without worrying about renewing each month. This is ideal if you want to take your time or explore more in-depth topics.

Month-to-Month – Gives you 55% off for the first month only, and then you’ll be billed at the regular monthly price from the second month onward. This option works if you’re confident you can finish your Nanodegree quickly or just want to try it out before committing to a longer plan.

✅ Recommendation: If you plan to complete your program over several months, the bundle subscription offers better value and long-term savings.

Can I combine this with other offers or scholarships?

No — Udacity’s 55% off discount cannot be combined with other promotions, coupon codes, or scholarships. You’ll need to choose either this limited-time same or any other eligible offer, but not both.

What kind of support do I get with a Nanodegree?

With a Udacity Nanodegree, you get a range of support to help you succeed, including:

1-on-1 technical mentor support – Get guidance when you’re stuck or need clarification on course content.

Personalized project feedback – Industry experts review your projects and provide actionable feedback.

Career services – Access resume reviews, LinkedIn profile optimization, and interview prep resources.

Student community – Connect with fellow learners in forums and study groups for motivation and peer support.

Flexible learning – Learn at your own pace with lifetime access to completed Nanodegree content.

This combination of technical help, career guidance, and community support ensures you’re not learning alone.

Read also: