In December 2025, Cornell University announced a $55 million gift from alumnus Stephen B. Ashley to endow the newly named Ashley School of Global Development and the Environment. The university presented the donation as a transformative investment in sustainability, global development, and interdisciplinary research. Yet behind the headlines of generosity lies a pattern that has come to define elite higher education: the use of philanthropy to launder reputations and sanitize wealth accumulated through systems that produce widespread harm.

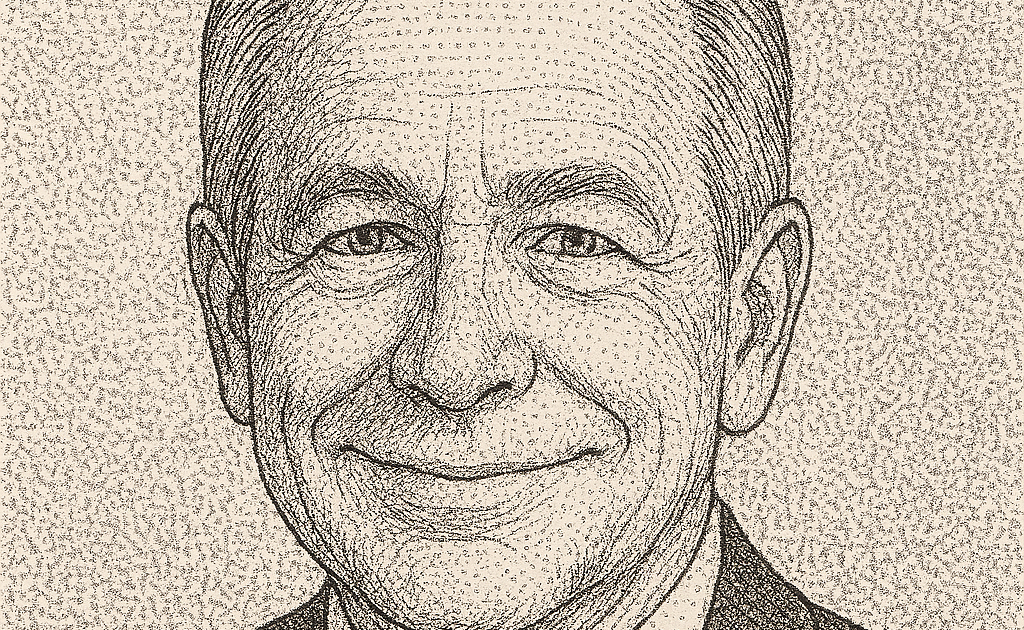

Ashley’s career exemplifies this dynamic. As a longtime real estate investor and head of The Ashley Companies, he amassed significant wealth. His tenure on the board of Fannie Mae, including as chairman in the mid-2000s, coincided with periods of accounting irregularities, risky mortgage practices, and systemic failures in governance. Fannie Mae’s collapse during the 2008 financial crisis devastated millions of Americans, particularly low-income and minority households, yet board members and executives largely escaped personal consequences. Ashley’s wealth, in part derived from this environment, is now being funneled into a university named for him — transforming historical responsibility into a narrative of generosity.

The pattern extends beyond domestic finance. Ashley also serves on the Founders Council of the Middle East Investment Initiative (MEII), a nonprofit focused on private-sector development in the Middle East. While MEII frames itself as a promoter of economic growth and development, critics argue that such organizations operate within a global financial ecosystem that prioritizes investor stability and elite networks over democratic accountability or local economic agency. Participation in these initiatives may be legal, even philanthropic, but they reinforce Ashley’s image as a global benefactor without confronting the broader systemic power he wields.

Cornell, like many elite institutions, accepts such gifts with minimal scrutiny, emphasizing the moral and intellectual good the donation enables while obscuring the histories of harm that made the wealth possible. Naming a school dedicated to equity, sustainability, and global development after a figure linked to financial crisis and speculative practices exemplifies the reputational laundering function universities serve for wealthy donors. The institution converts fortunes built in high-stakes, opaque, or socially harmful arenas into lasting prestige, moral capital, and scholarly legitimacy — all while reinforcing its own image as an engine of public good.

This is not a question of legality. Ashley’s wealth is largely untarnished in the courts. It is a question of accountability, ethics, and institutional values. By turning wealth into permanent naming rights, universities like Cornell signal that elite power can be absolved through philanthropy, creating a structural dynamic where generosity replaces responsibility, and reputation is more durable than accountability.

For students, faculty, and the public interested in environmental justice, social equity, and global development, the contradiction is stark. The same systems that generate inequality now fund the study and critique of inequality itself. Elite institutions benefit materially and symbolically from the work of those who profited from structural harm, even as the original consequences fade from public memory. Until universities confront this tension, higher education will continue to function as a reputational laundromat for elite wealth, transforming past systemic damage into present prestige.

Sources

Cornell University, “Historic Gift Endows New CALS School,” Cornell News

Cornell Sun, coverage of the Ashley School announcement

Federal Housing Finance Agency, Special Examination Reports on Fannie Mae (2005–2008)

Financial Crisis Inquiry Commission materials on Fannie Mae governance

Reuters, coverage of post-crisis shareholder litigation involving Fannie Mae board leadership

Middle East Investment Initiative, Board and Founders Council listings

Aspen Institute, background on MEII origins